Read next

According to a recent diversity study, the share of women on the boards of companies owned by private equity investors remained low in 2022. However, the share of women on boards increases during the ownership period of private equity investors. The study also revealed that the boards of private equity-backed companies are significantly more international than other Finnish non-listed companies.

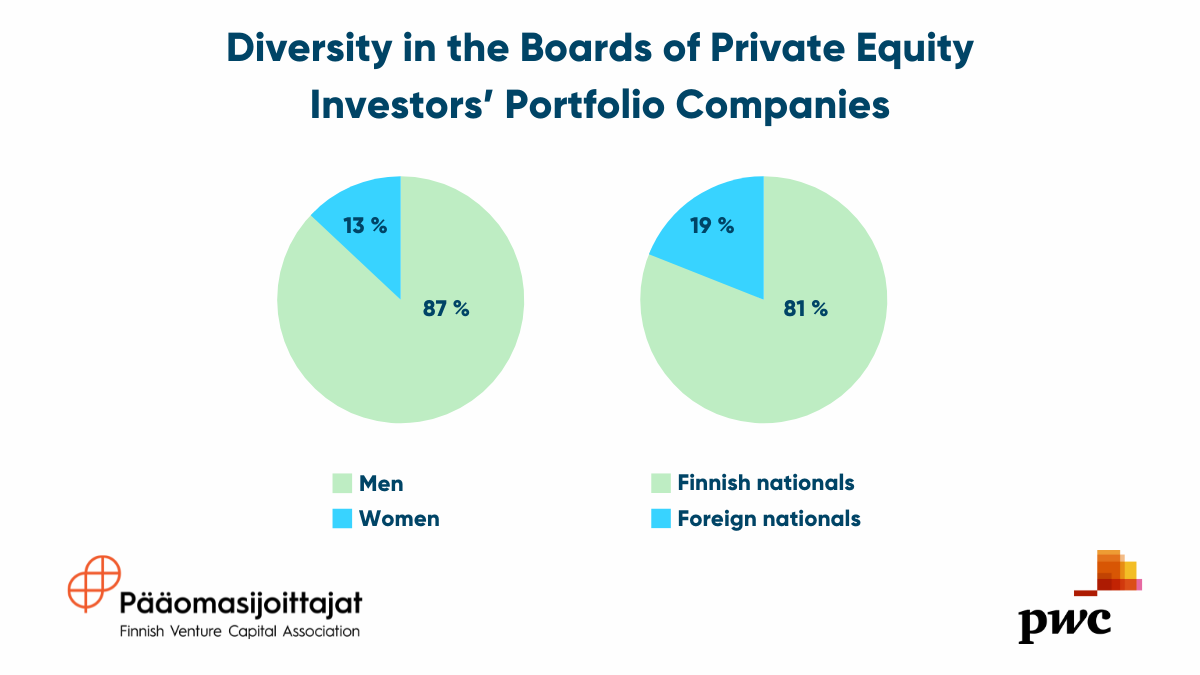

In a study conducted by the Finnish Venture Capital Association (FVCA) and PwC, 484 non-listed Finnish companies owned by private equity investors were examined. Women are still significantly underrepresented on the boards of these portfolio companies, as only 13% of board members were women in 2022. This percentage has slightly increased compared to 11% in 2021.

“Comparisons can be drawn from the broader Finnish business landscape as well as internationally. The gender diversity of boards in companies owned by private equity investors is on par with other non-listed Finnish companies, but there is room for improvement compared to Sweden, for example – A Swedish study showed that women constituted 19% of board compositions in private equity portfolio companies,” comments Jussi Lehtinen, Partner at PwC.

“It’s important to draw these comparisons, but also to remember that diversity is far from being achieved in these groups of companies, too – the goals should be set even higher,” adds Anne Horttanainen, Managing Director of the Finnish Venture Capital Association.

Nevertheless, the study found that private equity ownership appears to have a positive impact on gender diversity in boards when examining the same company over multiple years during the ownership period. Out of the companies studied, 72 reported on the diversity of their boards over a four-year period, from 2019 to 2022. In these companies, the share of women on boards increased from 9% to 12% during the ownership period.

“As active owners, private equity investors have the opportunity to influence their portfolio companies’ operations – including board diversity. Private equity investors should also be pioneers in this area. Purposeful and persistent efforts to promote diversity must continue with even greater determination,” comments Horttanainen.

Private Equity-Backed Companies’ Boards More International than Their Peers

In addition to analysing gender distribution, the diversity study also examined the internationality and age distribution of board compositions. The study revealed that board members of private equity-backed companies are, on average, slightly younger and significantly more international compared to other Finnish non-listed companies.

In 2022, the average age of board members in private equity-backed companies was 45 years, which is five years younger than in other non-listed Finnish companies. Of the board members, 19% were foreign nationals, whereas the corresponding figure for other Finnish companies is 5%.

Internationality was particularly pronounced in venture capital-backed companies, i.e., Finnish startups, where 22% of board members were foreign nationals. For mid-sized companies backed by buyout and growth investors, the proportion of foreign board members was lower – 11% for buyout-backed companies and 14% for growth-backed companies.

“The differences are likely partly explained by the fact that startups are often more international in nature than other companies. Startups also often involve foreign VC investors who hold board positions,” clarifies Lehtinen.

“Private equity investors help their portfolio companies to grow and expand internationally. Since growth often comes from abroad, it’s natural to seek international experts for boards, bringing in new skills and networks,” Horttanainen concludes.

Read the full study here.

Additional information:

Anne Horttanainen

Finnish Venture Capital Association, Managing Director

anne.horttanainen@fvca.fi

+358 40 510 4907

Jussi Lehtinen

PwC/Strategy&, Partner

jussi.lehtinen@pwc.com

+358 20 787 8756

FVCA is the industry body and public policy advocate for the venture capital and private equity industry in Finland. As the voice of the Finnish VC and PE community and the entrepreneurs they fund, it is our role to demonstrate the positive impact of the industry on the Finnish economy. FVCA – Building growth.

Twitter | LinkedIn |Instagram | For Media | Subscribe to FVCA’s Newsletter

PwC’s purpose is to build trust in society and solve important problems. In Finland, we have 1,300 experts working around the country. Our services include consulting, deals, tax, legal, risk assurance, audit and other assurance services. More information: www.pwc.fi/en. Twitter: @PwC_Suomi.

PwC operates in 152 countries and employs nearly 328,000 experts worldwide. PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/structure for further details.