Read next

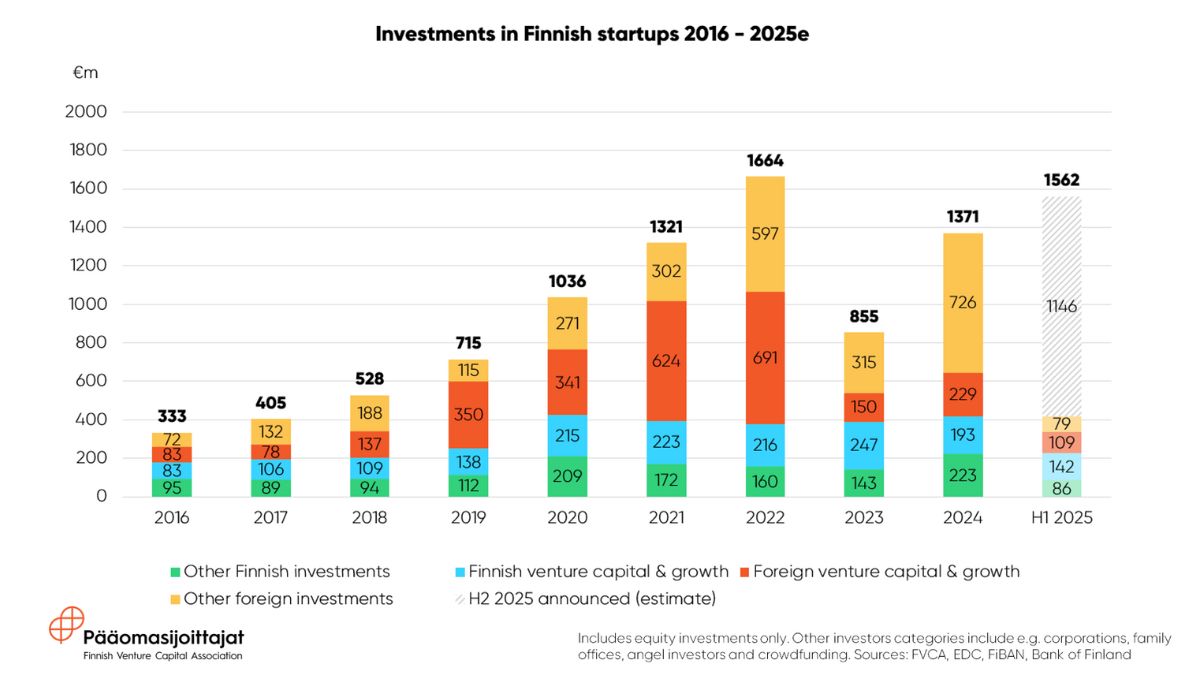

Finnish startups have been raising capital at a record pace this year. According to new statistics from the Finnish Venture Capital Association (FVCA), startups raised €400 million in investments during the first half of the year. With several major rounds completed later in the year, the total amount is now estimated to have exceeded €1.5 billion. Domestic venture capital investors have committed the second-highest sum in history, and the public sector has also increased its participation. However, fundraising for new funds continues to lag.

According to the Finnish Venture Capital Association’s latest data, Finnish startups raised €400 million during the first half of the year. Significant rounds in the latter half are expected to lift the total for 2025 to around €1.5 billion – pointing to a record-breaking year. In the autumn, major new investments were announced, including Oura, which secured the largest funding round in Finnish history (€777 million), and IQM, which raised the fifth-largest round (€275 million).

Finnish venture capital firms invested a total of €226 million during the first half of the year – the second-highest half-year figure on record. Of this amount, €112 million was directed to later-stage startups.

The public sector has also increased its investments in later-stage startups, in line with the investment strategy published earlier this year by Finnish Industry Investment (Tesi). Public-sector investments rose to an exceptional €74 million, compared to the typical €10–20 million range seen in previous half-year periods.

“Finnish venture capital funds are heavily involved in startups’ early stages, but their share tends to shrink in larger growth rounds. It would be in Finland’s best interest for Finnish ownership to continue as long as possible,” says Jonne Kuittinen, Deputy Managing Director of the Finnish Venture Capital Association.

During the first half of the year, Finnish venture capital firms raised only €106 million in new investable capital for their funds – the second-lowest amount in recent history. Economic uncertainty has reduced mergers and acquisitions and exits, slowing the return of capital to fund investors and making fundraising more difficult.

“Currently, growth in the Finnish economy can be found only in professionally owned unlisted companies. This presents strong opportunities for Finnish return-seeking investors going forward,” says Riku Asikainen, Chairman of the Board at Finnish Venture Capital Association.

Following the reporting period, Lifeline Ventures announced Finland’s largest-ever venture capital fund – €400 million – which is expected to push total annual fundraising to record levels despite the challenging market conditions.

Read more about the statistics here (pdf)!

***

Additional information:

Jonne Kuittinen

Finnish Venture Capital Association, Deputy Chief Executive

jonne.kuittinen@fvca.fi

+358 44 333 3267

Riku Asikainen

Finnish Venture Capital Association, Chair of the Board

riku.asikainen@evli.fi

+358 50 2880