Read next

Finnish buyout funds that invest in established growth companies now have a record amount of 3 billion euros available for investing in promising companies looking for growth.

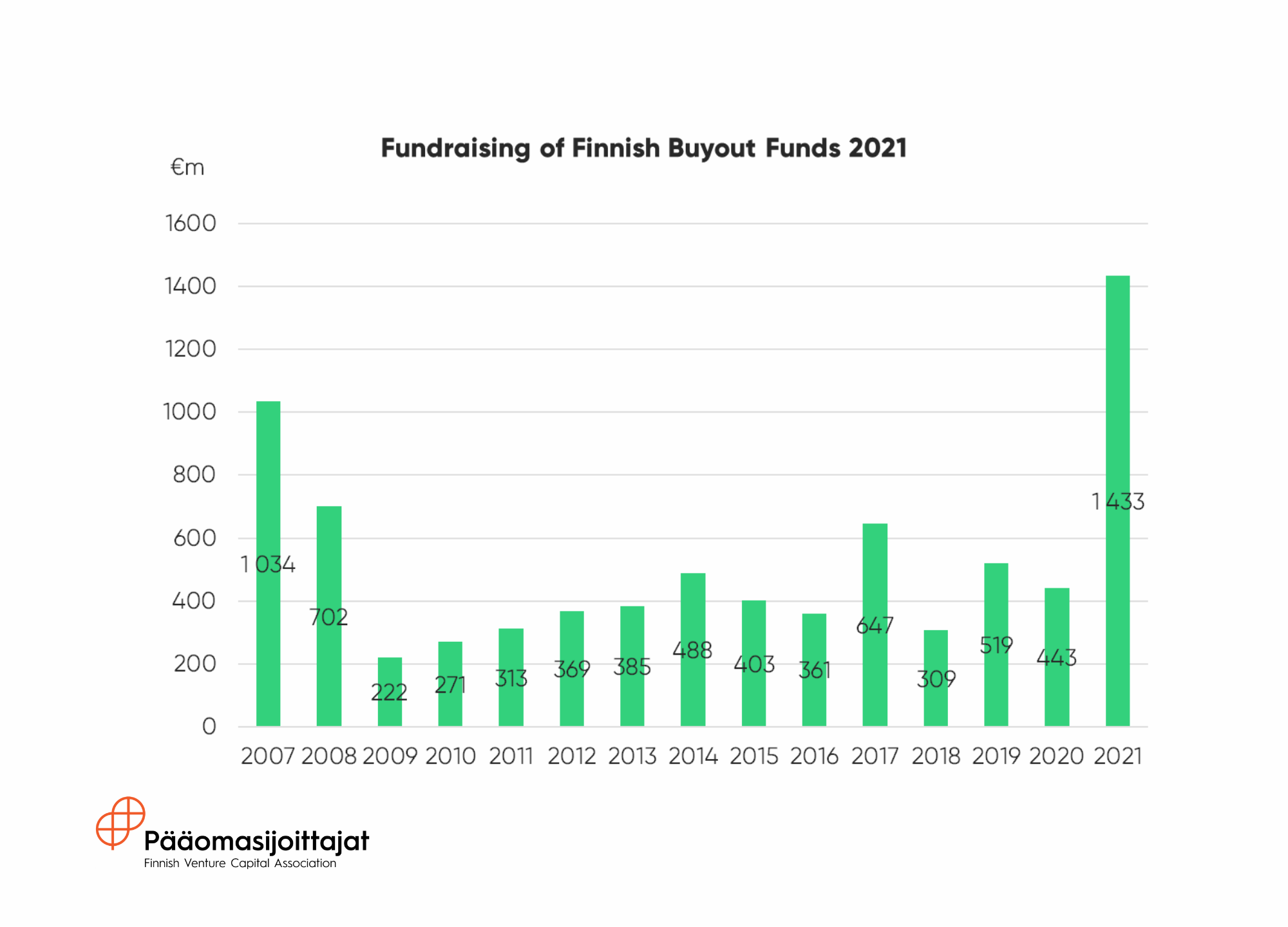

Finnish buyout investors who invest in established non-listed growth companies raised a record-breaking amount of new funds in 2021, a total of €1.4 billion. Between 2016 and 2020 around 450 million euros was raised annually.

The largest investor group in Finnish buyout funds was pension funds. In 2021, 36 percent of funds were raised from pension funds, 16 percent from funds of funds and 12 percent from family offices. In the last years, the biggest increase in fund investments has been from family offices.

Successful fundraising year anticipates many new investments

In 2021, a few of Finland’s largest private equity firms launched new funds, e.g., Intera Partners (€335m) and Vaaka Partners (€250m). Additionally, Korona Invest launched a new fund (€80m) and CapMan expanded their investment strategy with a new Special Situations fund (€53m) that specializes in demanding strategic and operational turnarounds.

Buyout funds invest in profitable, non-listed companies with a revenue of at least a few million euros and potential for growth. Buyout investors’ ideal target companies are looking for a partner to, for example, rejuvenate operations, boost international growth, ease generational change or prepare for an IPO.

Finnish buyout firms’ capital under management is €6.5bn, of which €3bn are available for new investments.

Pia Santavirta, the Managing Director of Finnish Venture Capital Association (FVCA), comments: ”2021 was an excellent fundraising year for Finnish buyout firms. The funds available for investments have risen to 3 billion euros. This is great news for companies that are seeking funding and an experienced partner for growth.”

Finnish buyout funds’ returns rank high in European comparison

Finnish buyout funds have excelled in European comparison. According to the Finnish state-owned investment company Tesi’s newest statistics on investment returns, as many as 45 percent of Finnish buyout funds belong to the top quartile of funds in Europe (read more on Tesi’s release, May 5th 2022).

Private equity fund returns are based on target companies’ rise in value during the ownership. According to Tesi’s statistics, in the recent years the annual return of Finnish buyout funds has been 17 %. Compared to the public stock market, namely OMX Helsinki General Index, Finnish buyout funds have generated a sizeable extra return with a multiple of 1.17x.

Juhana Kallio, FVCA vice chair and partner at the private equity company Intera Partners, comments: ”Buyout investors and their portfolio companies have together excelled in achieving the growth targets. This has led to impressive returns for the fund investors and has allowed the buyout funds to grow in size.”

Santavirta concludes: ”In addition to positive returns to the fund investors, buyout investments have a larger positive impact. The achieved growth has created new jobs, stronger medium sized companies, and new listed companies in Finland. To further accelerate this development, we need to ensure that Finnish business environment is the best in Europe for companies, investors and talent.”

More information:

Finnish Venture Capital Association

Managing Director

Pia Santavirta

pia.santavirta@paaomasijoittajat.fi

+358 40 546 7749

Finnish Venture Capital Association (FVCA) is the industry body and public policy advocate for venture capital and private equity investors in Finland. We represent a diverse group of investors who build sustainable growth through portfolio companies employing over 70,000 people. Finnish Venture Capital Association – Builders of Growth.

Twitter | LinkedIn | Media | Subscribe to Newsletter

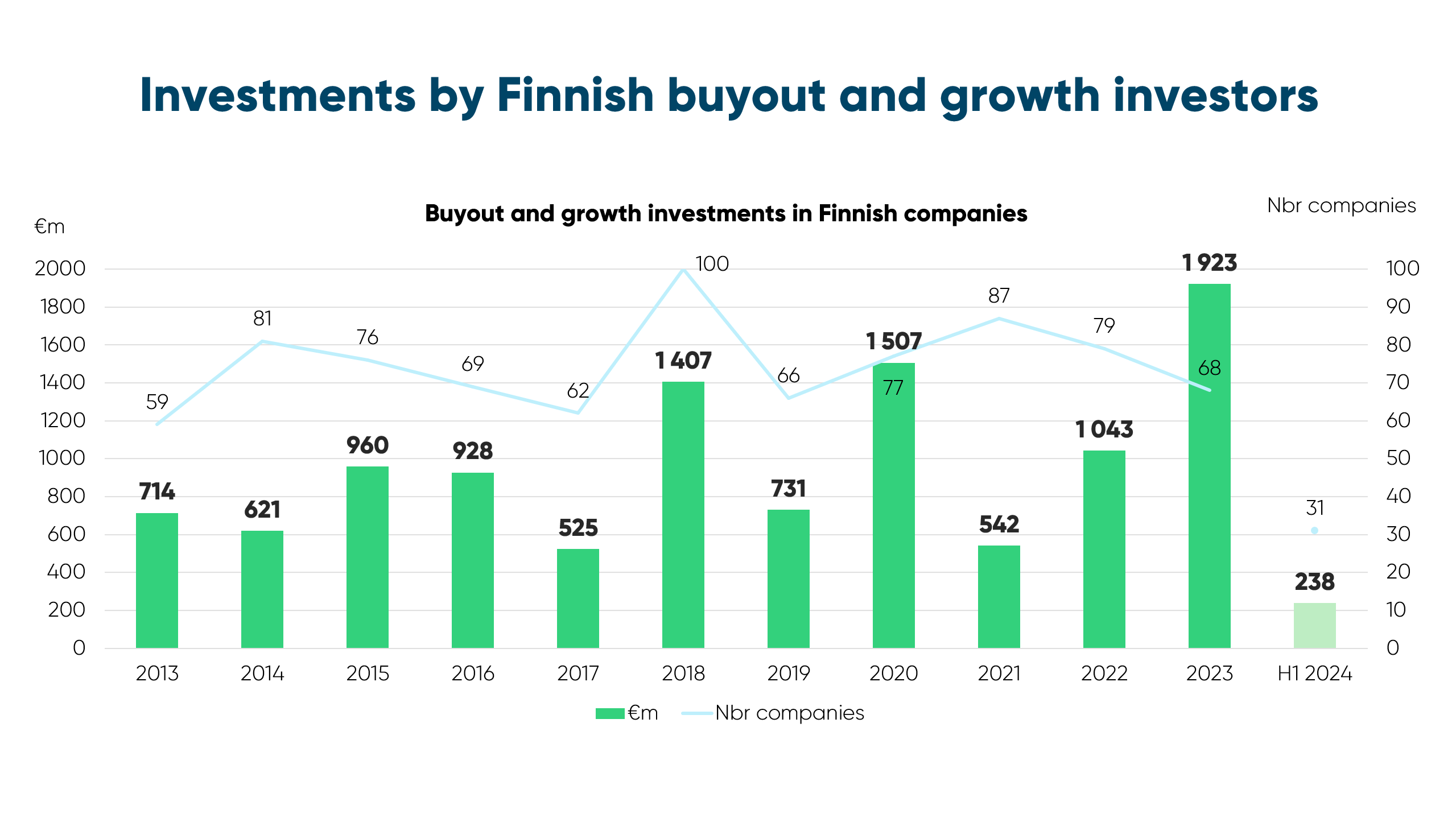

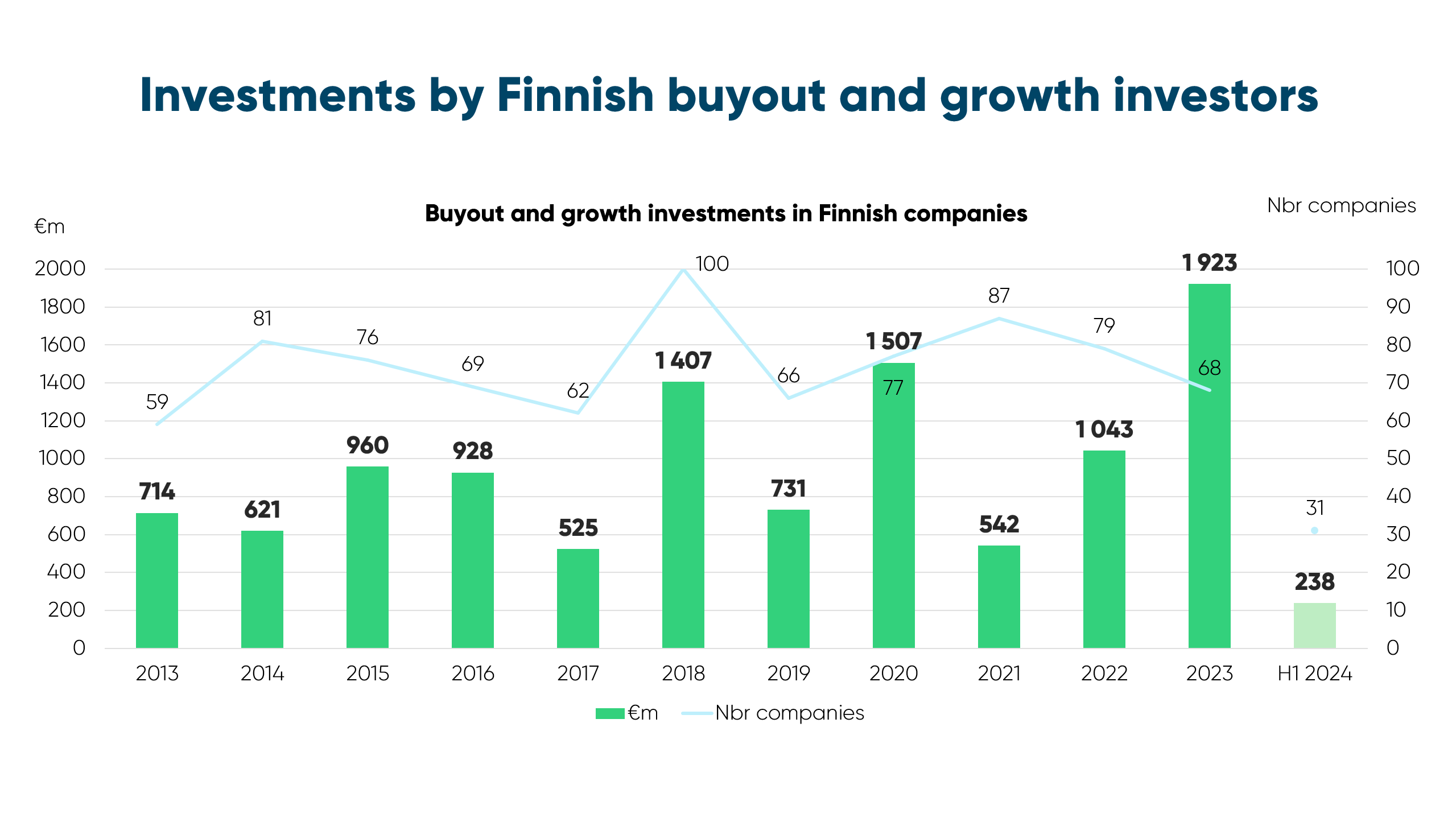

Highlights from 2021 private equity activity (growth and buyout) in Finland:

PRIVATE EQUITY INVESTORS

Private equity investors are active owners. They invest in non-listed startups and growth companies aiming at strong growth, innovation, and internationalisation. Private equity investors bring their portfolio companies not only capital but also risk appetite, expertise, and extensive contact networks. Private equity investors typically exit the portfolio company after 3 to 7 years, after which the company moves on to its next strategic growth phase. Potential exit methods include, for example, an IPO, selling the company to another private equity investor or a trade sale.

Private equity investors can be divided into two separate groups.

1) Venture capital investors make investments from venture capital funds into startups, becoming minority owners in their portfolio companies.

2) Buyout investors target more established growth companies. The investments can be majority or minority investments. The minority investments are often called growth investments.

This release covers buyout funds and established growth companies.