Read next

Finnish venture capital investors are increasingly investing in companies outside Finland. Although investments are made in many different sectors, ICT companies have raised the most funding. Finnish investors participate especially in seed-stage investment rounds, which represent about half of all international investments made.

In 2020, Finnish venture capital investors (later VC investors) invested a record €274 million in startups and early-stage growth companies. Of this amount, €51 million was invested in foreign companies. The number of investments directed outside Finland has increased in recent years, which indicates the internationalisation of Finnish VC investors’ operations.

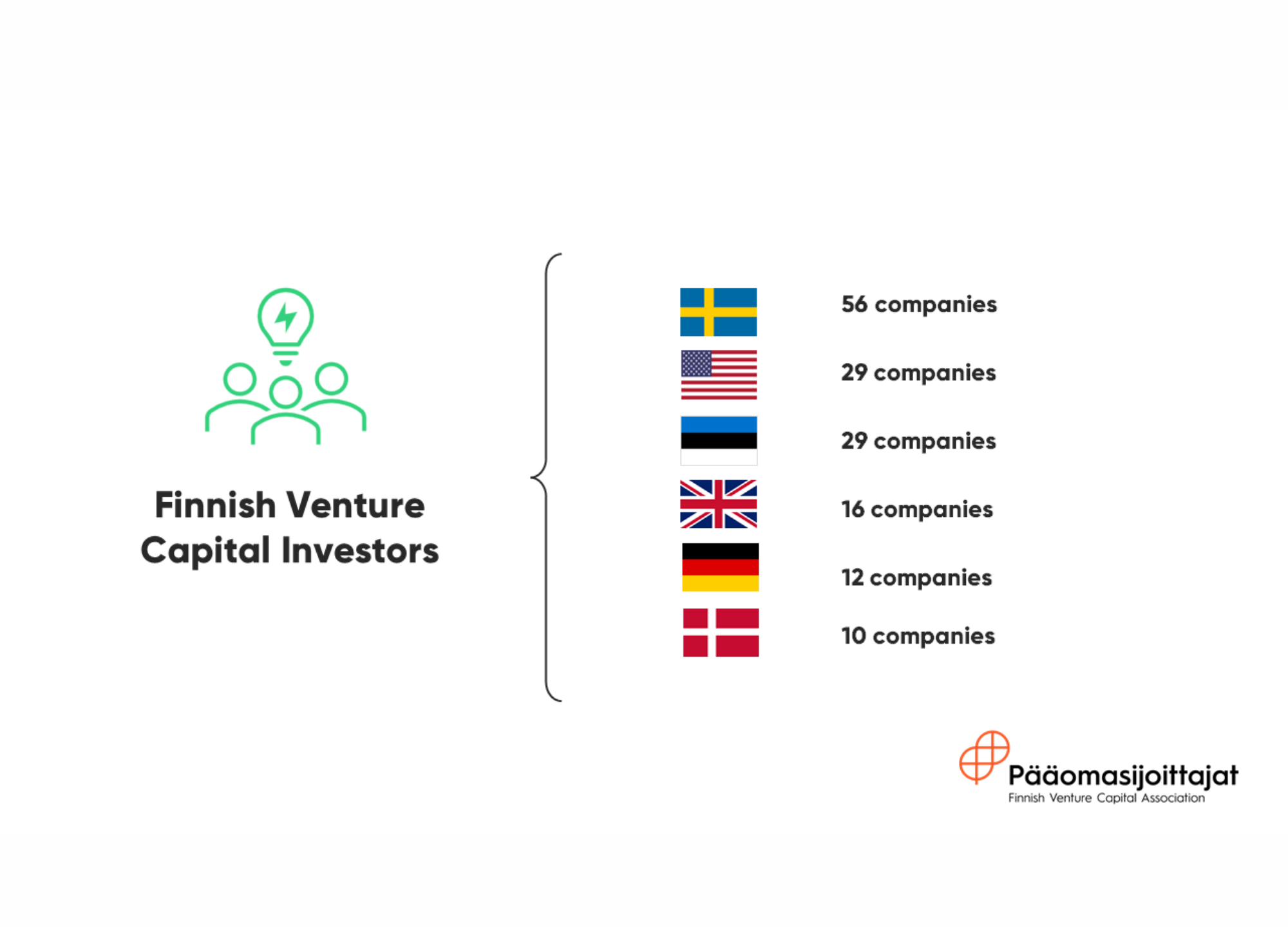

The 13 most active Finnish VCs investing internationally have made a total of 146 investments in foreign startups and early-stage growth companies.

According to the Finnish Venture Capital Association’s statistics, the most internationally active Finnish VC investor is Inventure, which invests in early-stage startups. Inventure has invested in 29 foreign companies, which corresponds to 16% of all international investments made by Finnish VC investors. Other Finnish VC investors who are particularly active abroad include OpenOcean (19), Lifeline Ventures (18), Gorilla Capital (17) and Icebreaker.vc (12).

“The network we have built over the decades is very valuable as it makes it easier for us to help our portfolio companies build international growth, recruit top talent, and raise follow-on funding. Not being solely focused on the domestic market also helps us find the best portfolio companies for our funds,” says Sami Lampinen, founding partner of Inventure.

Most investments have been made in Sweden, both in terms of capital invested and the number of investments. In addition to Sweden, Finnish venture capital investors have invested in companies in the United States, the United Kingdom and Germany, for instance.

According to the data, Finnish VC investors are interested in the same industries both in Finland and abroad. During the analysis period, ICT companies received the most investments from Finnish VCs. In addition, a number of investments have been made in B2B and B2C product and service providers, biotechnology, and health technology.

During the analysis period, about a half of Finnish VC investors’ international investments were made in seed-stage startups. The share of start-up phase investments was 38% and the share of later-stage venture phase investments was 10%.

Finnish investors often make international investments syndicated with other investors: 75% of investments by Finnish investors in foreign companies have been made together with one or more co-investors. The co-investors have been, for example, Danish Heartcore Capital, Norwegian Northzone and Swedish Creandum, all investors that have also actively invested in Finnish companies.

The internationalisation of the Finnish venture capital industry and the expansion of networks are beneficial in many ways. Due to expanding international networks, Finnish investors have a larger number of promising companies in their radar. Finnish companies aiming at international markets benefit from the fact that their investors have experience from other markets outside Finland. In addition, the cooperation between Finnish and foreign investors brings both international investments and top talent from different fields to Finland.

“Internationalisation is a prerequisite for our financial ecosystem to remain competitive and keep evolving. It has been great to see that the Covid-19 pandemic did not reduce the international investments of Finnish VC funds – rather the opposite,” concludes Pia Santavirta, the Managing Director of FVCA.

Pia Santavirta

Finnish Venture Capital Association, Managing Director

+358 40 546 7749

pia.santavirta@fvca.fi