Read next

The Finnish Venture Capital Association follows the development of gender diversity both in private equity and venture capital teams and in the boards of portfolio companies. Although the share of women is still far behind the share of men, some positive development is visible especially in the boards of more established growth companies and in the partner appointments of private equity and venture capital companies.

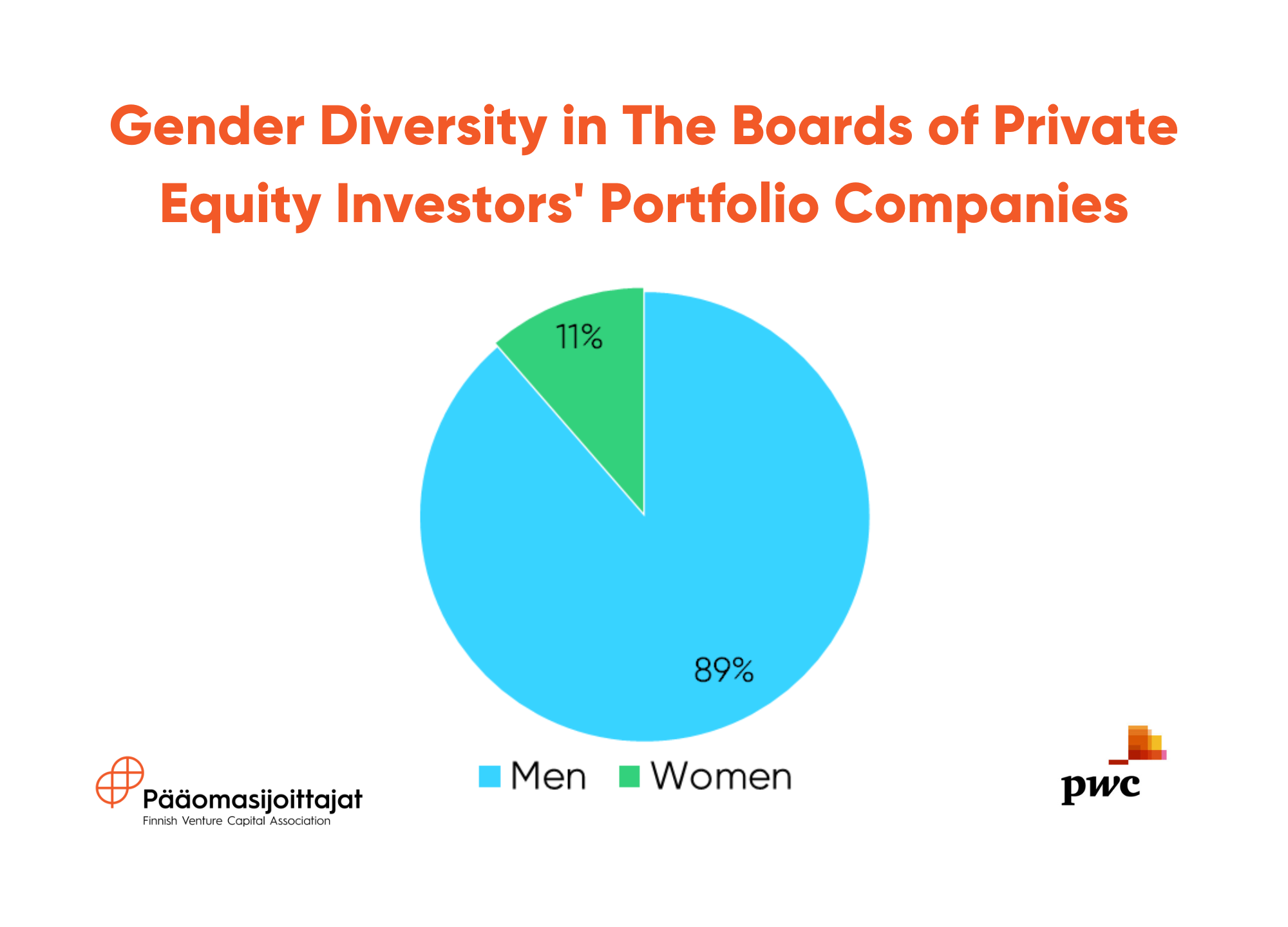

In the survey made by the Finnish Venture Capital Association (FVCA) and PwC, 411 unlisted companies owned by private equity and venture capital investors (PE & VC investors) were examined. According to the report, the share of women on the boards of PE & VC investors’ portfolio companies remained at a low level: only 11 % of board members are women. The number has remained almost the same for the last few years.

Of the companies included in the survey, 124 reported on the diversity of their boards from a slightly longer period of time, between 2019 and 2021. The survey revealed that a PE investor has a positive effect on the diversity of boards when the same company is examined over several years. The positive effect can be seen in more established growth companies, where the share of women rose from 13 % to 17 % in majority-owned companies (buyout) and from 11% to 14 % in minority-owned companies (growth). In companies owned by venture capital investors, the proportion of women in board positions slightly decreased, from 7 % to 6 %.

“More established growth companies are often bigger, and their boards are larger than those of new technology companies, which can make increasing the diversity of boards less challenging in the big picture“, explains Jussi Lehtinen, partner at PwC.

There are clear differences between industries: women typically rise to the boards of companies offering consumer products and -services and retail. On the other hand, women are less often seen in board positions amidst industrial services, -products, and technology.

“More work needs to be done in board elections to find more women on company boards. Women also need to boldly apply for leading roles, so that their capabilities for board work are strengthened“, says Pia Santavirta, managing director of FVCA.

The private equity and venture capital industry is growing fast – also the share of female partners is increasing

According to the annual diversity review carried out by the FVCA, in the fall of 2022, a total of 527 people worked in PE company teams in Finland. The number of personnel increased by 11 % from last year.

In the entire personnel, the share of women stayed at last year’s level at around 27 %. The share of women in investment teams making investment decisions was 25 %.

The number of female partners is growing. After the summer of 2021 eight women have been appointed as partners in PE and VC companies, i.e., the number of female partners is currently 28. However, there are still approximately four times as many men as partners compared to women, and 12 men have been appointed as partners since the previous diversity review.

Furthering diversity in private equity and venture capital teams and portfolio companies is encouraged in the industry’s updated recommendation on sustainable investing. Active efforts to increase diversity are also being made in PE and VC teams.

”Versatile skills are needed in the industry. It’s nice to see that several private equity and venture capital teams have internship programs, and new women are appointed as partners in funds. Although there is still much to be done to further diversity in the industry, the direction is right”, says Suvi Collin, Head of Legal & ESG at the FVCA.

New partners in Finnish VC & PE teams are:

Read more in the report

Pictures and logos for media

More information:

Pia Santavirta

Finnish Venture Capital Association, managing director

pia.santavirta@fvca.fi

+358 40 546 7749

Jussi Lehtinen

PwC/Strategy&, partner

jussi.lehtinen@pwc.com

+358 20 787 8756

Suvi Collin

Finnish Venture Capital Association, Head of Legal & ESG

suvi.collin@paaomasijoittajat.fi

+358 50 560 3532

Finnish Venture Capital Association (FVCA) is the industry body and public policy advocate for the venture capital and private equity investors in Finland. We represent a diverse group of investors, that build sustainable growth and whose target companies employ more than 70 000 employees.

Twitter | LinkedIn | Instagram | Subscribe to our newsletter

PwC’s purpose is to build trust in society and solve important problems. We help companies to improve their efficiency, promote growth and to report reliably in a constantly changing environment. In Finland, we have 1 200 experts working around the country. Our services include consulting, deals, tax, legal, risk assurance, audit and other assurance services. More information: www.pwc.fi/en. Twitter: @PwC_Suomi.

PwC operates in 155 countries and employs more than 327,000 experts worldwide. PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/structure for further details.