Read next

The amount of capital raised by Finnish startups reached a new record last year. Of the total amount invested in Finnish startups, almost 60 per cent came from venture capital and growth investors.

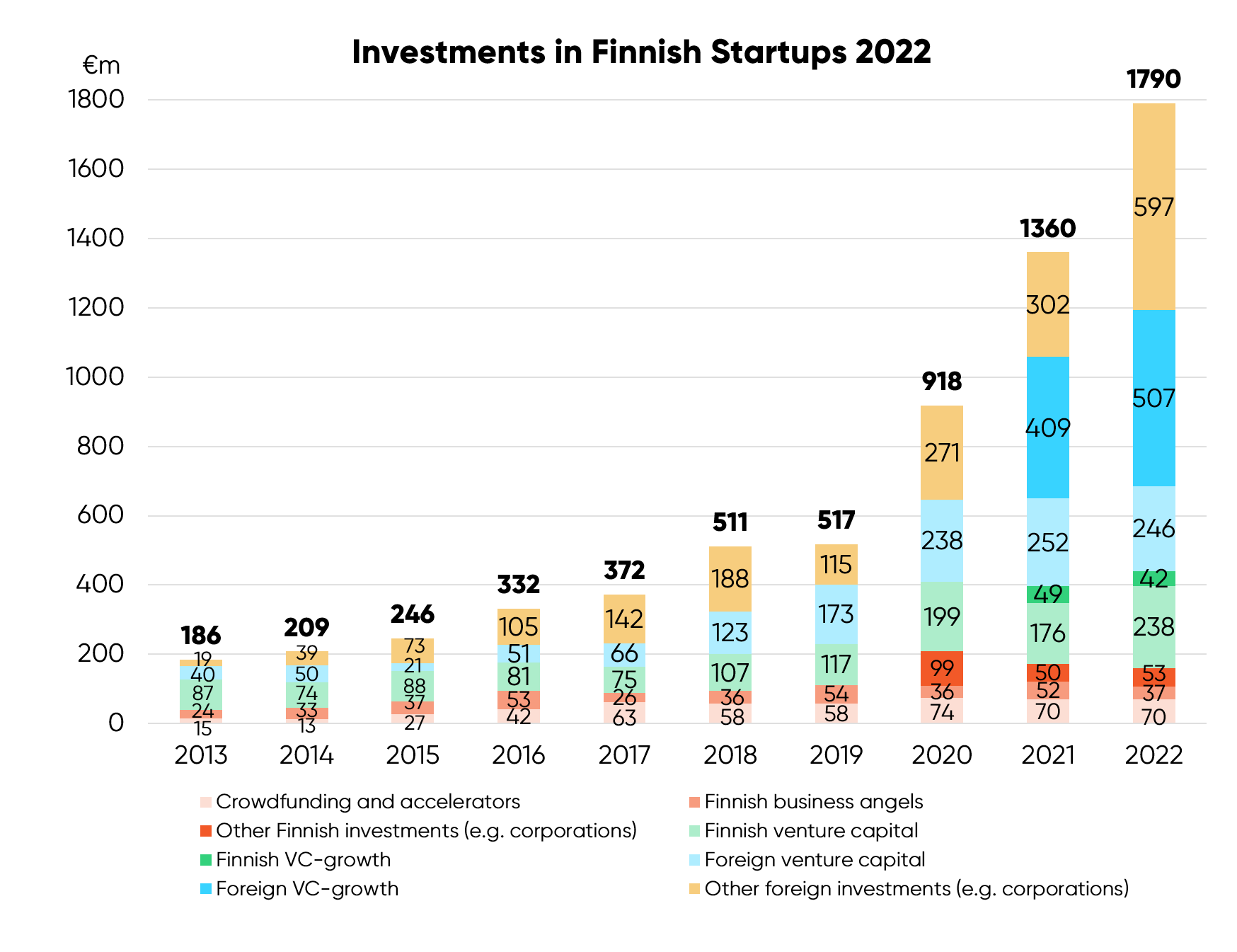

Finnish startups have once again raised a record amount of funding. The amount invested increased by almost half a billion from the previous year, totalling €1.8 billion in 2022.

“The amount of funding raised by Finnish startups has increased tenfold in the last ten years. We have seen especially great leaps in the last four years, and the long-term development has also been positive,” says Anne Horttanainen, Managing Director of the Finnish Venture Capital Association.

Startups raise funding from several different types of investors. As in previous years, most of the funding came from venture capital and growth investors, who invested over one billion euros in Finnish startups in 2022. There has been a significant increase from the previous year’s sum of €886 million. Of the amount invested in 2022, €280 million came from domestic and €753 million from foreign VCs and growth investors.

Other foreign investors, such as corporates and LPs, invested a significant amount of €597 million euros in Finnish startups. Other domestic investors invested a total of €160 million.

The record sum was heavily boosted by supply chain and retail planning platform Relex’s €500 million investment round and open-source cloud data platform Aiven’s €200 million round. Other large investment rounds were raised by quantum computer developer IQM (€128 million) and satellite technology company Iceye (€120 million).

“The largest funding rounds are often led by foreign investors. Financing of tens or hundreds of millions cannot be done by Finnish efforts alone, and for our startups to compete with the global leaders, we also need to be able to attract international capital,” comments Horttanainen.

The Finnish Venture Capital Ecosystem Is Maturing and Internationalising

Finnish venture capital investors play a significant role in the growth and development of startups. With the financing provided by VCs, startups can grow from the idea stage all the way to conquering international markets.

In 2022, Finnish venture capital investors made a total of €358 million in investments. Of this amount, €238 million were invested in Finnish companies and €120 million in foreign companies. The development and internationalisation of the Finnish venture capital ecosystem are reflected by the data: Finnish venture capital funds have increasingly invested in foreign startups in recent years.

“Internationalisation is visible in both Finnish startups and VCs. The strengthened global networks are an advantage for a small market like ours,” comments Jussi Sainiemi, partner at Voima Ventures and chairperson of FVCA’s venture capital committee.

Fundraising of Finnish venture capital funds was successful in 2022. A record amount of capital was raised, totalling €402 million. The previous record year was 2019, with €345 million raised. In 2022, FOV Ventures and Innovestor Life Science launched their first funds. Inventure, Butterfly Ventures, and Wave Ventures also raised new funds.

“The development is positive – the sizes of funds have grown, and new funds have been established. While we already have a few larger VC funds, we are still missing the funds with hundreds of millions under management, which often lead later-stage investment rounds,” says Horttanainen.

Investor sentiment, as revealed by a survey conducted by the FVCA in March 2023, indicates that fundraising has become more challenging compared to previous periods.

“The general economic uncertainty naturally creates challenges for this industry as well. Now is the time to make sure that unnecessary obstacles to fundraising are removed to secure the availability of funding for Finnish startups in the future,” Horttanainen says.

Staying on the Right Path

In the past four years, the Finnish startup and venture capital ecosystem has grown in leaps. Startups have attracted record amounts of capital year on year, several companies have grown into international success stories, and VCs’ fundraising has been successful.

The outlook for future development, however, is uncertain. Based on statistics, investment activity in Finland remained at a good level even towards the end of 2022, while it already slowed down in Europe and the United States. According to the investor survey, Finnish VCs feel that there are still good investment opportunities available, but recently, there has been discussion in Finland about the declining number of new startups being founded.

The decrease in the number of startups also worries Horttanainen: “The development of the venture capital industry and the entire ecosystem is the result of the long-term work of many players. To ensure that this good development does not suffer a setback, cooperation to promote growth and entrepreneurship must continue. I also expect ambitious initiatives towards growth and entrepreneurship-friendly policies from our new government,” she concludes.

Background: VC-growth

Additional information:

Anne Horttanainen, Managing Director, FVCA

+358 40 510 4907, anne.horttanainen@fvca.fi

Jussi Sainiemi, Partner, Voima Ventures

+358 40 564 4660, jussi.sainiemi@voimaventures.com

Juulia Korkiavaara, Head of Communications, FVCA

+358 40 673 8376, juulia.korkiavaara@fvca.fi

FVCA is the industry body and public policy advocate for the venture capital and private equity industry in Finland. As the voice of the Finnish VC and PE community and the entrepreneurs they fund, it is our role to demonstrate the positive impact of the industry on the Finnish economy. FVCA – Building growth.

Twitter | Linkedin |Instagram | For Media | Subscribe to FVCA’s Newsletter