Read next

The amount of funding raised by Finnish startups in the first half of the year has decreased from the record numbers of previous years. Smaller investment rounds and the decrease in foreign investments explain the drop in the total funding amount. Finnish venture capital investors have achieved record fundraising, and investments in early-stage startups, in particular, are actively being made.

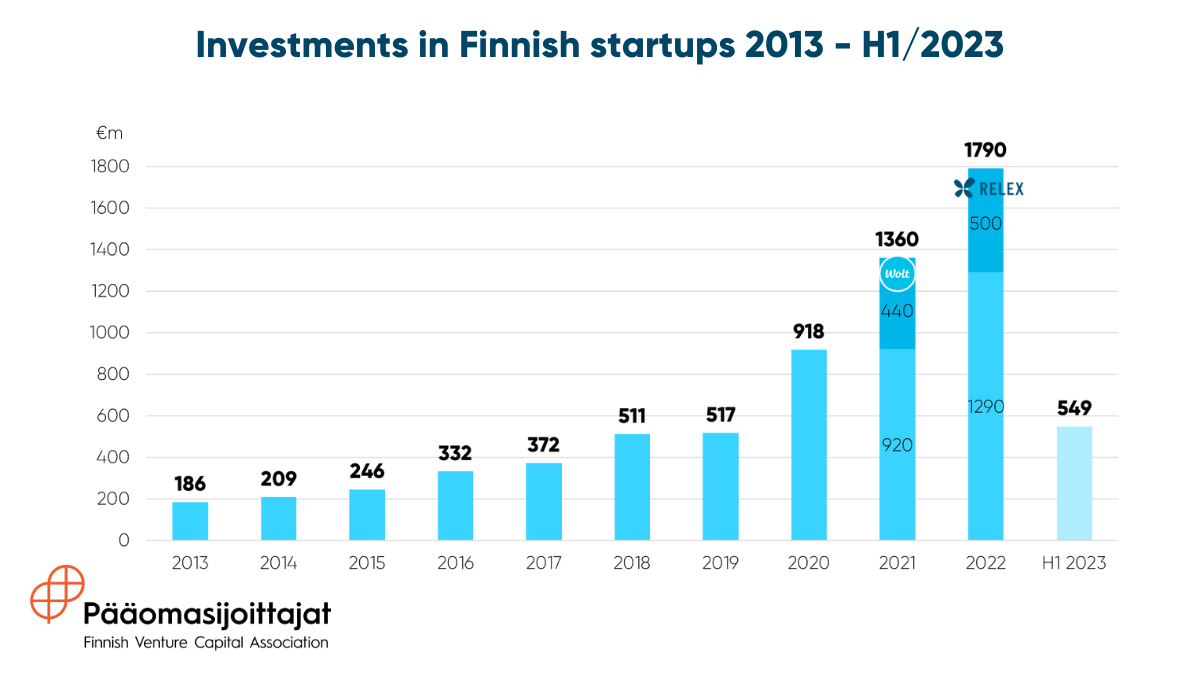

Finnish startups have raised a total of €549 million in growth capital during the first half of 2023, according to the latest statistics from the Finnish Venture Capital Association (FVCA). The share of venture capital and growth investments of the total sum is €270 million.

Based on the results from the year’s first half, the drop from peak years is significant. The Finnish startup ecosystem has experienced tremendous growth in recent years, with the amount of funding raised increasing year after year. In 2022, Finnish startups received an unprecedented €1.8 billion in investments, with venture capital and growth investments accounting for slightly over one billion euros.

“The slowdown in startup funding was observed in other parts of Europe and the United States in 2022, and considering the changed global situation, a decrease in investments was also anticipated in Finland. On a larger scale, this is undoubtedly partly a healthy correction in an overheated market,” comments Jussi Sainiemi, Deputy Managing Partner of the venture capital firm Voima Ventures and Chair of FVCA’s Venture Capital Committee.

In terms of the number of investments, Finnish startups have received investments in the first half of 2023 at a pace similar to previous years. The overall decrease in the total funding amount is mainly explained by the reduced activity of foreign investors and the absence of large investment rounds led by them, as well as a general decrease in the size of funding rounds.

“Of the fifteen largest startup investments in Finnish history, five, such as Relex‘s record-breaking €500 million, occurred in 2022. Hostaway raised a €162 million investment round in the first half of this year in a challenging market situation, but otherwise, large rounds have been absent this year,” remarks Jonne Kuittinen, Deputy Chief Executive of the FVCA.

“The role of Slush in attracting international investors to Finland is perhaps more crucial this year than ever,” he continues.

Record amounts raised by Finnish venture capital funds

The activity of Finnish investors in the first half of the year reflects the broader market situation: the number of investments has stayed relatively stable, but the invested amount has decreased from record levels. In total, 131 startups have received investments worth €124 million from Finnish venture capital and growth investors.

One record, however, has been broken this year: Finnish venture capital funds have raised €265 million in the first half of 2023, making it the best fundraising half-year in history. In the spring of 2023, Lifeline Ventures and Voima Ventures published their new funds.

“The successful fundraising of domestic investors is crucial for the Finnish startup ecosystem. The role of domestic investors is emphasised in challenging times when foreign investors are less active in the Finnish market,” Kuittinen points out.

Seed-stage investments made by Finnish investors have continued at a historically high level, so plenty of funding is still available for early-stage startups.

“A strong group of domestic VC investors ensures the availability of funding for the best companies even in uncertain times. Funding rounds may be more moderate, but portfolio companies are continuously supported, and new targets are constantly sought,” Kuittinen says and adds:

“We have not yet seen large rounds in the second half of the year, and there is a sense of anticipation in the market. The activity of Finnish VC investors in earlier-stage investments lays the groundwork for an increasing number of companies in Finland ready for larger follow-up funding rounds once again when the time is right.”

Read more about the H1/2023 statistics here.

Additional information

Jonne Kuittinen

FVCA, Deputy Chief Executive

jonne.kuittinen@fvca.fi

+358 44 333 3267

Jussi Sainiemi

Voima Ventures, Deputy Managing Partner

jussi.sainiemi@voimaventures.com

+358 40 564 4660

Juulia Korkiavaara

FVCA, Head of Communications

juulia.korkiavaara@fvca.fi

+358 40 673 8376