Read next

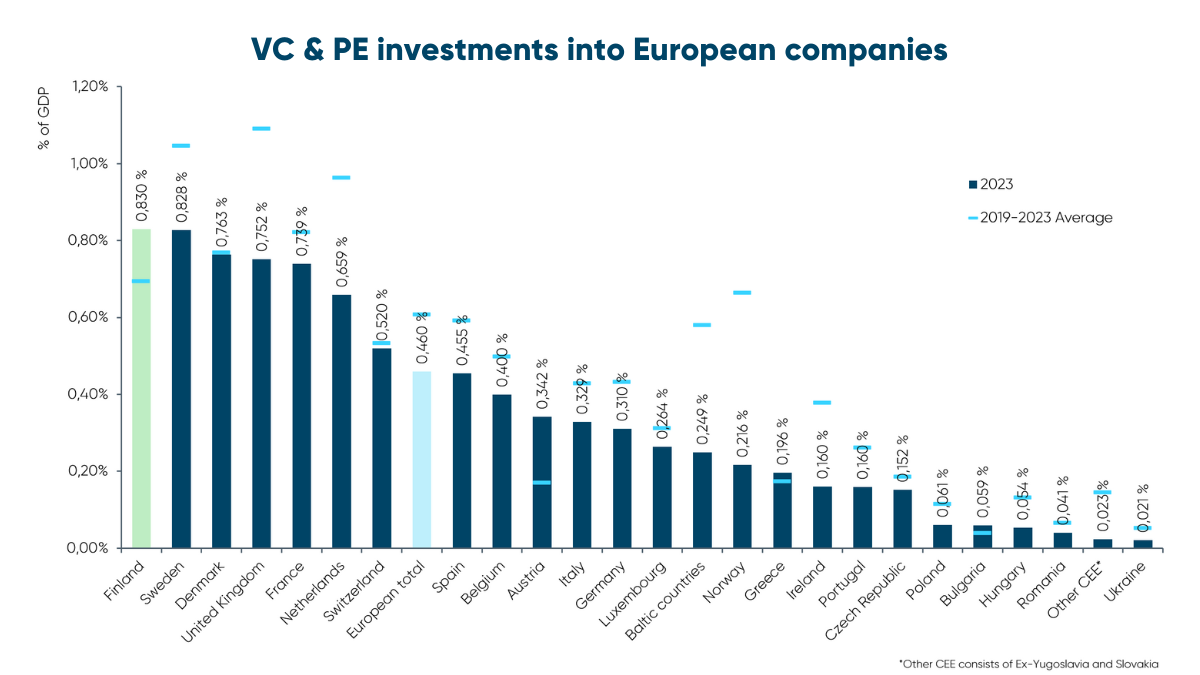

According to recent statistics from Invest Europe, the umbrella organisation for European private capital, Finnish companies received the most private equity investments relative to GDP in Europe last year.

Finland slightly outpaced countries such as Sweden, Denmark, and the UK in terms of private equity investments relative to GDP. Compared to the European total, Finnish companies attracted nearly twice as much investment in relation to GDP.

This top ranking is attributed to sustained interest from private equity investors in Finnish companies, even as investments plummeted in many other countries due to global economic uncertainty. In 2023, private equity investments in European companies fell by 25%. Among Nordic countries, investments in Norway fell by 65% and in Sweden by 35%. In contrast, investments in Finnish companies remained steady.

“Private equity investors are professional owners seeking the best global opportunities. Our top ranking indicates that Finland has world-class companies that attracted significant investment, even during a globally challenging year for startup financing and the M&A market alike,” comments Jonne Kuittinen Deputy Chief Executive of the Finnish Venture Capital Association.

Private equity investors target companies ranging from early-stage startups to established growth companies. In 2023, notable private equity investments in Finland included electric car charging platform Virta, IoT company Haltia, software company Hostaway, digital auction service Huutokaupat.com, and accounting firm Rantalainen.

When looking at different investment categories, Finland ranked first in minority investments in scaleups and established companies, and third in majority investments in established companies. The country placed sixth in startup investments, having topped this category four times in the past five years.

“Finnish start-ups have frequently led the rankings, and as they have scaled, we have now taken the top spot in that category. In addition, with the help of domestic private equity investors, we have also developed an increasing number of strong internationalising companies in more traditional sectors that are of interest to foreign investors,” Kuittinen adds.

In 2023, 65% of private equity investments in Finnish companies came from foreign investors. Among the Nordic peers, this share is close to Norway (61%), but higher than in countries such as Denmark (41%) and Sweden (44%). For example, in the UK, the share of foreign investments is only 24%.

In established markets with large local private equity investors, a higher proportion of funding typically comes from domestic sources. However, Finnish private equity funds are relatively small, leading to a reliance on foreign investors for large funding rounds and major acquisitions.

“It’s great that Finnish companies attract international investments, but we lag behind many European peers in domestic investment. There’s room for improvement in our private equity market. We need larger and more international domestic funds to further develop our companies with local resources,” Kuittinen concludes.

Read more about the Invest Europe annual activity data here.

Jonne Kuittinen

FVCA, Deputy Chief Executive

jonne.kuittinen@fvca.fi

+358 44 333 3267

Juulia Korkiavaara

FVCA, Head of Communications

juulia.korkiavaara@fvca.fi

+358 40 673 8376