Read next

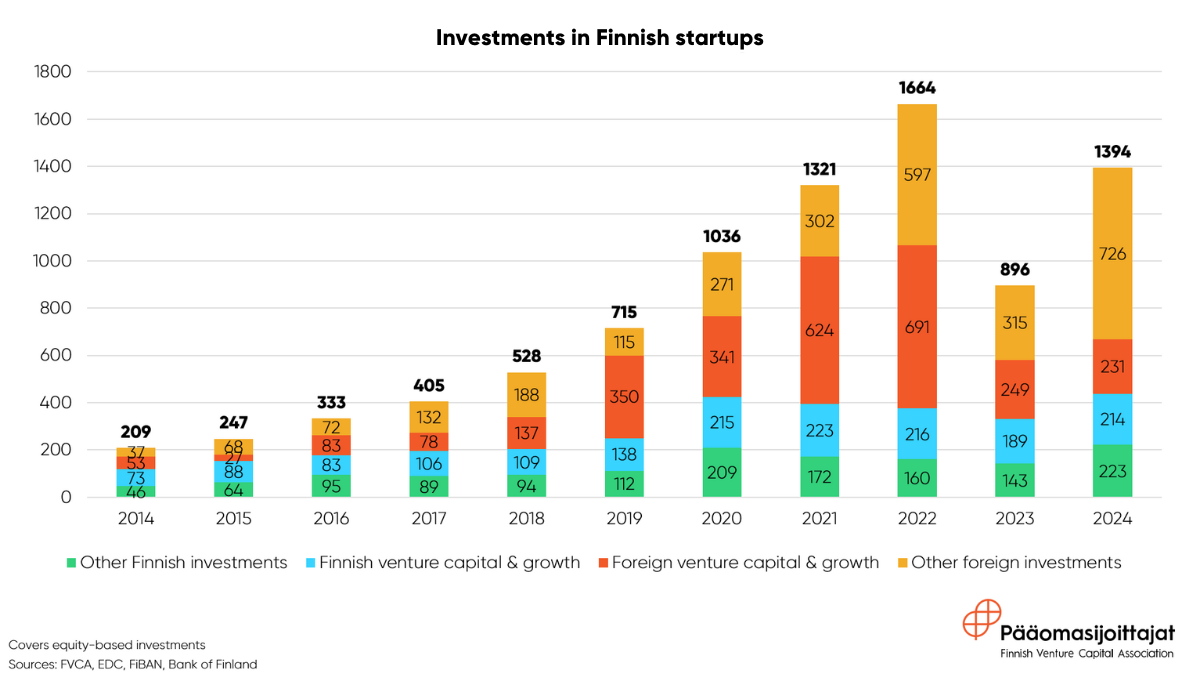

In 2024, Finnish startups raised a total of €1.4 billion in investments, which is 56% more than in the previous year, according to recent statistics from the Finnish Venture Capital Association. The growth was boosted in particular by a few larger funding rounds at the end of the year. Without foreign capital, the figures would be considerably weaker, as domestic investors cannot keep up with the large funding rounds.

According to the latest statistics from the Finnish Venture Capital Association, startup investments continued to decline in Europe, but in Finland the trend was clearly better: investments increased by as much as 56% compared to 2023. The main driver of the growth has been foreign investors, who brought almost €1 billion in new capital to the country.

Foreign investment in Finnish startups rose to as much as €957 million in 2024. Investments rose by 70%, almost doubling from €564 million in the previous year. At the same time, domestic capital is mainly concentrated in early-stage companies, with large growth-stage funding rounds still largely dependent on foreign investors.

”Finland stands out in Europe as a unique startup market, where funding was raised last year at a pace close to that of its best years. The hard work of Finnish startups and the funding and support of Finnish private equity and venture capital investors through difficult times are now being reflected in successful large follow-on funding rounds as the international growth funding market is once again picking up”, says Jonne Kuittinen, Deputy Chief Executive of the Finnish Venture Capital Association.

At the end of 2024, we saw a few exceptionally large funding rounds that boosted the statistics. Hostaway, Oura and Iceye attracted the largest investments – almost €700 million in total, but mostly from international investors.

While Finnish private equity and venture capital investors are active in early-stage investments, there is a clear shortfall in growth-stage funding. Finland lacks sufficiently large growth-stage funds, which means that we do not have access to later funding rounds – and successful companies end up in foreign hands.

Sustainable growth requires a functioning capital market that mobilizes domestic capital and actively attracts international investors. The small size of Finnish funds limits the financing of growth companies and the duration of domestic ownership – and makes it difficult to attract international capital.

“Professional ownership matters. Finland’s economic growth needs more large domestic private equity and venture capital funds. This requires international investors in addition to domestic capital. The current regulation is not competitive – we need a completely renewed legislation for fund management companies and the best investment environment in the world”, says Riku Asikainen, Chair of the Board of the Finnish Venture Capital Association.

Read more about the statistics here (pdf)

***

Additional information:

Jonne Kuittinen

Finnish Venture Capital Association, Deputy Chief Executive

jonne.kuittinen@fvca.fi

+358 44 333 3267

Riku Asikainen

Finnish Venture Capital Association, Chair of the Board

riku.asikainen@evli.fi

+358 50 2880