Read next

The latter half of 2024 brought a boost to the Finnish private equity market. There were more exits than since early 2022, with funds raising approximately one billion euros, according to fresh statistics from the Finnish Venture Capital Association. Despite the historically low number of investment targets, investments in growth companies reached record levels, driven by an exceptionally large single investment. The market shows potential, but the direction for the current year depends on the stability of the operating environment.

The fourth quarter of 2024 was the most active for Finnish buyout investors in over three years, as per the Finnish Venture Capital Association’s data. There were a total of nine exits, accounting for 43% of the year’s total exit volume – a level of activity not seen since early 2022. Exits significantly returned capital to fund investors and set the stage for new fundraising rounds. However, uncertainty reflecting into early 2025 is now slowing down the market just when acceleration seemed imminent.

Fundraising for buyout and growth funds was exceptionally strong in 2024. Finnish PE investors collectively raised approximately one billion euros for their funds, making it the third-largest year in recorded history – surpassed only by 2007 and 2021. New funds entering the market included CapMan, DevCo, Sponsor Capital, and Evli.

The market appeared promising at the beginning of the current year, but global uncertainties – geopolitical tensions, interest rate environments, and overall economic nervousness – have once again surfaced. Finnish investors are ready to act, yet global conditions are complicating matters.

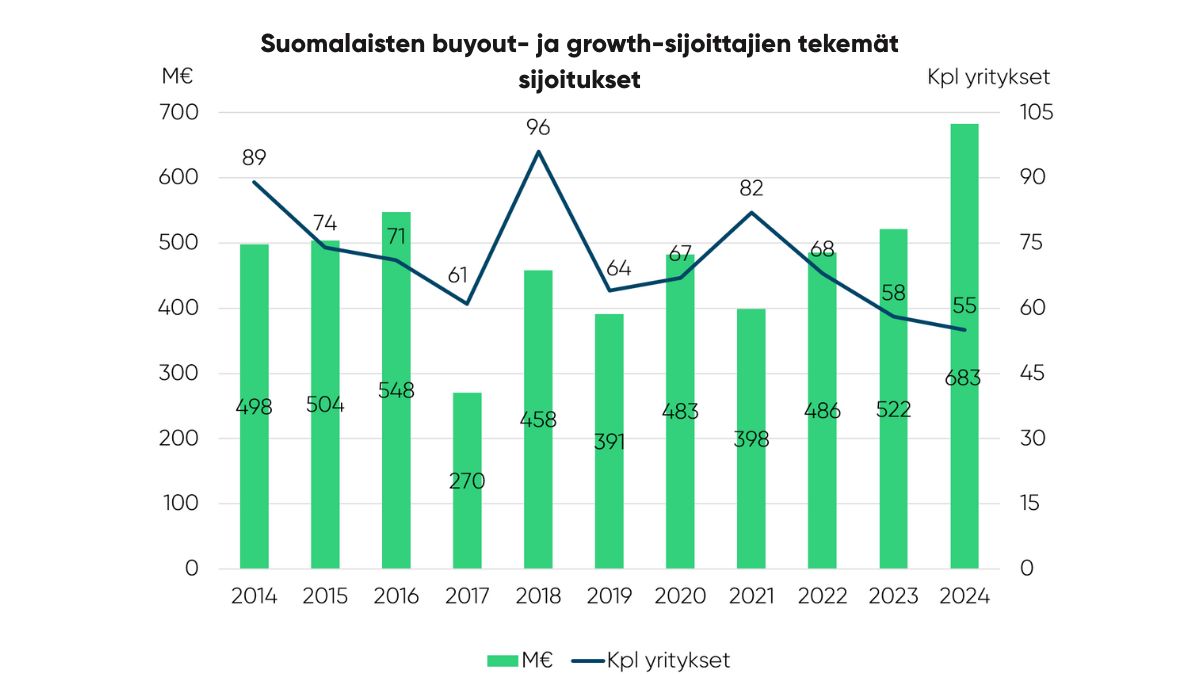

On the investment front, the year presented a mixed picture. Finnish buyout and growth investors made private equity investments with a total of 683 million euros in 2024. Investments in growth companies increased by 31% in euro compared to the previous year, significantly influenced by a single large investment. However, the distribution of investment across just 55 companies indicates a notably lower number of investment targets compared to previous years.

Clearing obstacles for growth

Despite the uncertainties in early 2025, Finland still holds excellent potential to emerge as a leader in growth entrepreneurship and industrial renewal. The sector is ready to act – what is needed is an operating environment that supports and encourages growth, not one that holds it back.

“Obstacles that can be removed must now be eliminated. The activity of private equity investors should not be unnecessarily restrained, as we have both the desire and the expertise to build sustainable growth,” says Anne Horttanainen, CEO of the Finnish Venture Capital Association.

Government decisions to accelerate growth are welcomed. It is crucial that growth-supporting measures quickly translate into practical actions – especially ones concerning fund structures, taxation, and the availability of skilled labor.

“At the same time, the target level must be sufficiently ambitious, and decisions supporting growth must decisively move Finland forward. We should not settle for moderate competitiveness but aim for the world’s best operating environment for private equity and growth entrepreneurship”, continues Horttanainen.

Read more about the statistics here (pdf)

***

Additional information:

Anne Horttanainen

Finnish Venture Capital Association, Chief Executive Officer

anne.horttanainen@fvca.fi

+358 40 510 4907