Read next

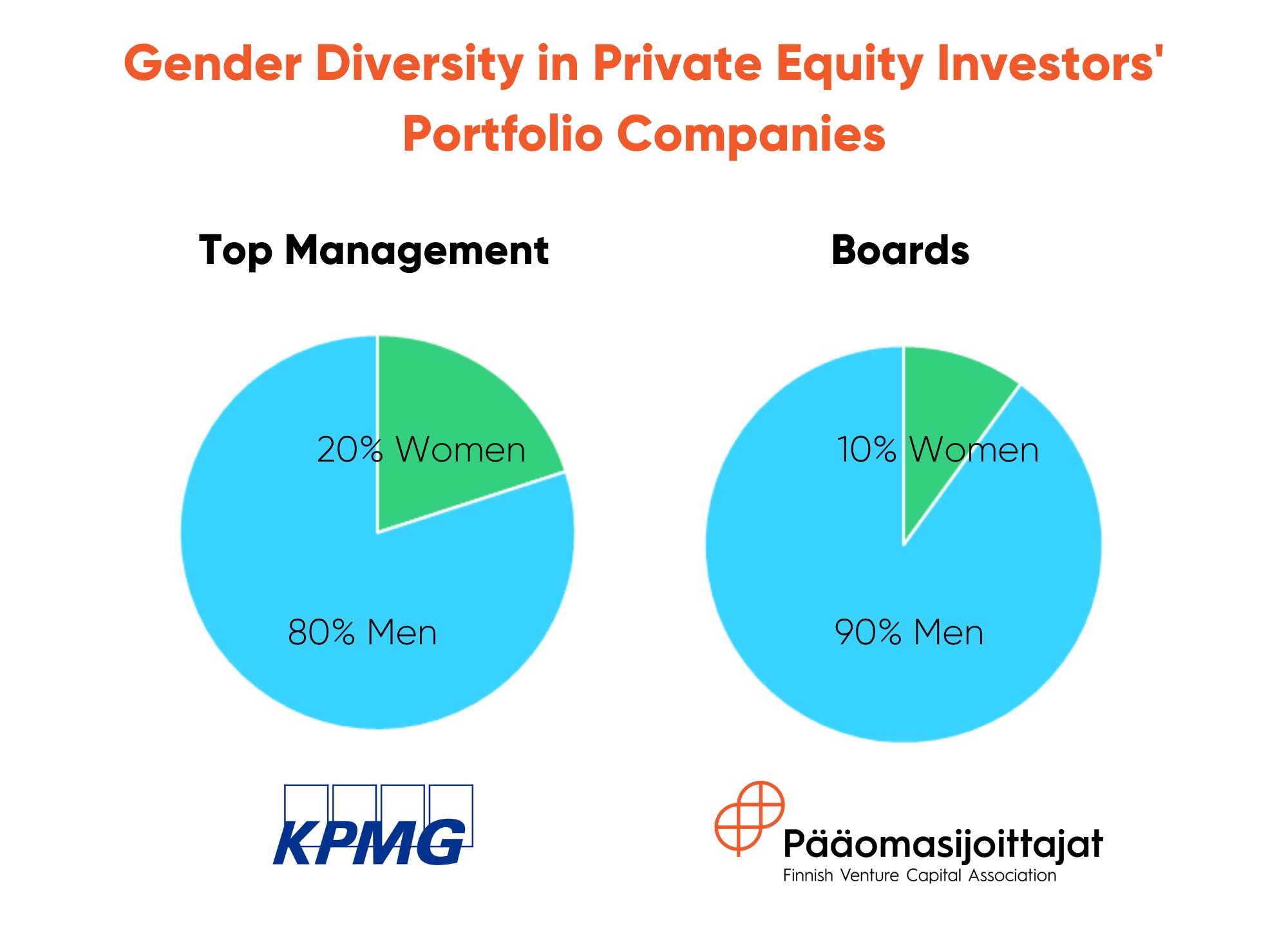

According to a diversity study conducted by the Finnish Venture Capital Association and KPMG now for the second time, the share of women on the boards of companies owned by private equity and venture capital investors has decreased, while the share of women in top management has increased.

In 2020, women held 10% of the board seats in Finnish private equity and venture capital investors’ portfolio companies. The number decreased slightly from 2019, when the share of women was 11%. In management teams, on the other hand, the gender gap has slightly narrowed. In 2019, women held 19% of top management positions, compared to 20% in 2020.

There was a clear change in the top management teams of venture-capital-backed startups, where the share of women increased from 15% to 18%. In more established, buyout-backed growth companies the share of women in top management teams remained at 24%.

“The diversity study was now conducted for the second time as part of the annual private equity industry impact study. We haven’t seen any major changes in gender diversity yet in the short period we have tracked, but the fact that the share of women in top management teams has increased is encouraging. As active owners, private equity investors have an excellent opportunity to influence the leadership diversity of high-growth companies,” comments Kenneth Blomquist, Head of Private Equity at KPMG.

“Diversity has also become a part of the investment criteria – even if a company is otherwise promising, an investment may not be made if there are shortcomings in the diversity of the company’s management and board, or if these issues aren’t acknowledged,” adds Pia Santavirta, Managing Director of the Finnish Venture Capital Association.

Increasing gender diversity is often challenging, especially in technology companies. There are relatively few women working in deep tech, for example, and they often lack important networks with startups and growth companies.

However, a lot is being done in the industry to increase diversity. This year, the Finnish Venture Capital Association began a collaboration with Nasdaq Helsinki with the aim of promoting diversity in business through training for management teams.

Actions to promote diversity have also been taken at fund level. Inka Mero, CEO and founding partner of deep tech fund Voima Ventures, and her team are actively working to find diverse talent for their fund’s portfolio companies. One practical step they have taken is organising the ‘Women to Boards’ event.

“Hundreds of women were interested in the initiative, and based on their competency profiles, we invited those who might fit our portfolio companies’ boards to attend the event. At the event, the companies introduced themselves to the potential board professionals. Our intention is to continue hosting these events, and several other venture capital funds are planning to join us”, Inka Mero says.

The event drew new talent to Voima Ventures’ portfolio companies. For example, Soile Kankaanpää, who was found through the initiative, recently joined the materials technology company Betolar’s board. In addition, numerous discussions on advisor, management team, and board roles have begun since the event.

“It is clear that our work to promote diversity and inclusion will continue. We want to attract top talent to the private equity and venture capital industry, startups, and growth companies. Studies have shown that diverse teams also produce great results, which, of course, is another factor that investors are interested in,” Santavirta concludes.

More information

The diversity study was conducted as a part of the annual private equity industry impact study. The study examined gender diversity in the top management and boards of Finnish private-equity-backed companies. The results are based on the 2020 gender distribution data, which was gathered from companies that received an initial investment from a Finnish private equity investor between 2010–2020. The sample comprised 222 companies, 85 of which were buyout-backed and 137 of which were venture-capital-backed.

Pia Santavirta, Finnish Venture Capital Association, Managing Director

pia.santavirta@paaomasijoittajat.fi

+358 40 546 7749

Kenneth Blomquist, KPMG, Head of Private Equity

kenneth.blomquist@kpmg.fi

+358 40 752 0000

Inka Mero, Voima Ventures, Founder & Managing Partner

inka.mero@voimaventures.com

+358 45 121 4394

FVCA is the industry body and public policy advocate for the venture capital and private equity industry in Finland. As the voice of the Finnish VC and PE community and the entrepreneurs they fund, it is our role to demonstrate the positive impact of the industry on the Finnish economy. FVCA – Building growth.

Twitter | Facebook | Linkedin | For Media| Subscribe to Newsletter

KPMG is a global network of professional services firms providing Audit, Tax and Advisory services. The independent member firms of the KPMG network are affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. Each KPMG firm is a legally distinct and separate entity and describes itself as such. We operate in 146 countries and territories and have 227,000 people working in member firms around the world.

Voima Ventures is a €45M deep tech fund that invests purely in startups with deep tech and scientific backgrounds. Voima Ventures’ mission is to solve major global problems by combining science, entrepreneurship, and capital. Industry domains include bio and new materials, medical technologies and life sciences, imaging and optics, IoT and electronics, robotics, software & ICT and AI. In addition, Voima Ventures is managing a portfolio of VTT Ventures with 20 prominent deep tech companies including Solar Foods, Paptic, and Dispelix. Cornerstone investors are VTT Technical Research Centre of Finland and European Investment Fund (EIF), backed by Finnish private and institutional investors.