Read next

Between 2017 and 2021 private equity and venture capital investors invested a total of €6.8bn in Finnish companies. Companies that grow both domestically and internationally and create jobs all around Finland can be developed through private equity investments. To promote sustainable economic growth in Finland, pro-entrepreneurship and pro-growth politics must be advanced from one government to the next.

Both Finnish and international private equity and venture capital investors are included in the €6.8bn investment figure. Of the total sum, €1.9bn are venture capital investments in startups and €4.9bn are buyout investments in more established growth companies. 61 per cent or €4.1bn of total investments were made by foreign private equity investors. A total of 800 Finnish startups and growth companies received venture capital and private equity investments.

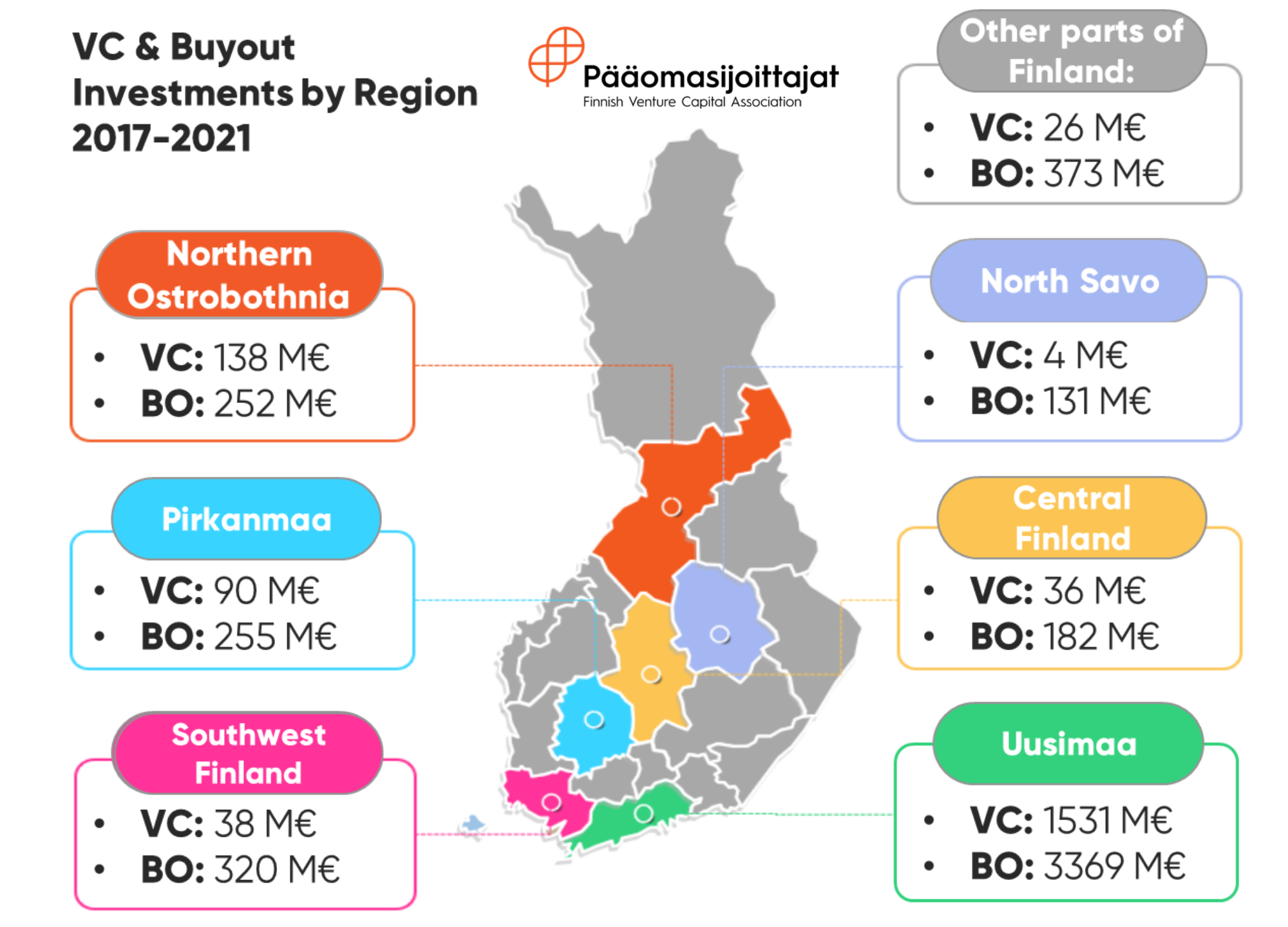

In addition to the Helsinki region, notable venture capital investments were made in companies located in other bigger cities in Finland, such as Oulu and Tampere. In comparison, buyout investors’ portfolio companies are more evenly distributed all over Finland.

The capital region of Uusimaa received the largest amount of venture capital investments: startups in the region raised a total of €1.5bn during the last five years. After Uusimaa, the highest amount of venture capital investments was raised by startups based in Northern Ostrobothnia and Pirkanmaa. Startups based in Northern Ostrobothnia raised €138 million of growth funding in five years, whereas in Pirkanmaa the amount was €90 million.

Uusimaa reached the first position in buyout investments as well. Between 2017 and 2021, around €3.4bn worth of investments were made by Finnish and foreign investors in established growth companies based in Uusimaa.

“The role of private equity and venture capital investors as the accelerators of company growth in Finland has become stronger year after year. Full implementation of digitalisation, acceleration of the green transition and generational change all increase demand for the type of active ownership that venture capital and private equity investors offer,’’ comments Pia Santavirta, Managing Director of the Finnish Venture Capital Association (FVCA).

We Need Long-Term Politics That Support Growth and Entrepreneurship

Economic growth is built by innovative tech companies and medium-sized companies that actively seek growth. The growth of these companies is often backed by private equity and venture capital investors.

Parliamentary elections are approaching, and we hope the decision-makers share our vision: we want Finland to be the best place for entrepreneurs, investors, and top talent.

The building blocks for growth are growth-minded entrepreneurs, a diverse pool of talent, and the innovations that form the foundation for new companies. When these pieces are in place, growth can be accelerated with the following means:

Company growth must be supported by the surrounding regulatory environment. It is important that politics that support growth and entrepreneurship are followed over governmental terms. Regulatory and taxation environments must be consistent and predictable. When regulation or taxation are revised, the effects that these changes will have on companies and their abilities to grow, find funding and employ must be carefully assessed. This helps to ensure that Finland remains an attractive and competitive country for entrepreneurs, professionals, and investors.

To strengthen domestic ownership and secure the availability of funding for growth companies, our financial ecosystem must reach the international level. This means that the obstructions for fundraising of Finnish venture capital and private equity funds must be removed, and funds must have equal opportunities of attracting investments to Finland. The Finnish venture capital and private equity industry must be constantly developed to keep up with the rest of Europe.

Sustainable Growth for Each Company Stage

More new startups

Our goal is for Finland to be among the top European countries when measuring the number of new startups. Right now, we are at number six, so there is catching up to do. More attention needs to be paid to entrepreneurial skills, innovation, and commercialising innovation.

More trailblazing unicorns

The Finnish startup ecosystem has set a goal: to have a hundred startups with a turnover of more than a hundred million by 2030. At best, new innovations and great teams can grow into exceedingly successful anchor companies, which in turn create expertise clusters around them. By the summer of 2022, eleven unicorns, i.e., startups worth more than one billion euro, have been built in Finland and we are looking forward to seeing more of them.

Regional growth

We wish for the whole of Finland to grow, develop and employ as many professionals as possible. There are many companies that represent traditional industries, which have the potential for more rapid growth. The growth of these companies must be accelerated. In addition to capital, private equity investors utilise their growth expertise to fully support their portfolio companies on their growth path.

Mittelstand companies

Our goal is for the Finnish midlevel (or mittelstand) company ecosystem to grow and strengthen. This requires pro-entrepreneur decision-making and experienced capital management.

More information:

More information:

Finnish Venture Capital Association

Pia Santavirta, Managing Director

pia.santavirta@paaomasijoittajat.fi

+358 40 546 7749

Finnish Venture Capital Association (FVCA) is the industry body and public policy advocate for venture capital and private equity investors in Finland. We represent a diverse group of investors who build sustainable growth through portfolio companies employing over 70,000 people. Finnish Venture Capital Association – Builders of Growth.