Read next

The subdued M&A market of the previous year has left its mark on private equity investments, witnessing a decline in activity among Finnish buyout and growth investors compared to preceding years. Nonetheless, the latest barometer tracking private equity investors’ sentiments reveals a notable uptick in future expectations, indicating a more positive outlook.

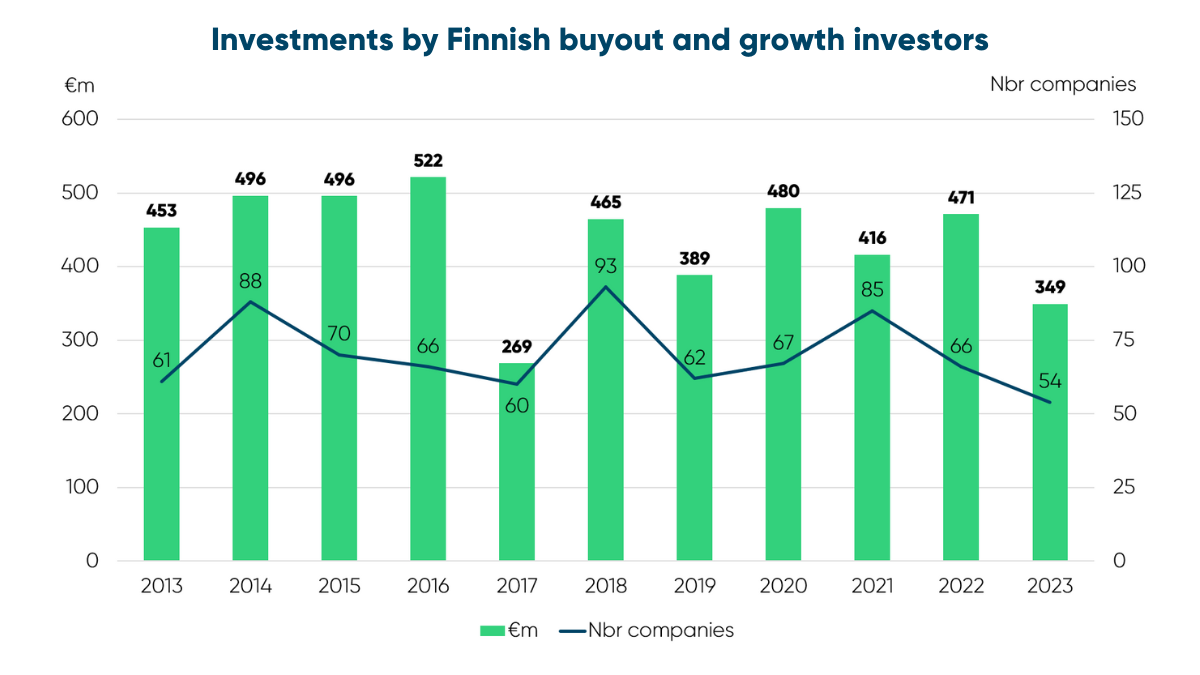

According to recent statistics from the Finnish Venture Capital Association (FVCA), Finnish buyout and growth investors invested a total of €349 million throughout 2023, spread across 54 companies. These investors target growth-oriented, unlisted SMEs.

The statistics depict one of the quietest years in a decade, with the deal count dropping by 18% compared to the previous year. Despite this decline, it remained relatively moderate in contrast to the global private equity market, which experienced a 20%* decrease in buyout deal count, and the broader Finnish M&A market, where transaction count dropped by 34%**.

The downturn in the M&A market is also reflected in exit activity. Finnish buyout and growth investors made historically few exits in 2023, which was particularly evident in the low number of trade sales.

“The uncertainty surrounding economic outlooks, coupled with inflation and rising interest rates, cast a shadow over the M&A market last year. Nonetheless, promising investment targets with growth potential persist despite economic conditions, and active discussions with companies are ongoing,” comments Juhana Kallio, Chair of the Board of FVCA and Managing Partner of Intera Partners.

Finnish buyout and growth funds raised relatively little new capital in 2023, totalling €261 million. This figure falls short of the annual average of half a billion euros observed over the past decade. One new fund focusing on sustainable forestry and biotechnology industries, launched by United Bankers, was announced during the year, while existing funds also attracted additional capital.

Part of the subdued fundraising can be attributed to several of Finland’s major private equity investors having launched funds in 2021, a year that saw record fundraising totalling €1.3 billion.

However, the fundraising market was particularly challenging last year.

”Nearly a third of the companies that have risen to the list of the 500 largest companies in Finland over the last ten years have a private equity background. To foster the growth of Finnish companies and bolster the mid-sized segment, nurturing a conducive fundraising environment for private equity funds is paramount”, comments Jonne Kuittinen, Deputy Chief Executive of FVCA, and continues:

”For instance, the government’s recent decision to investigate enhancing investment avenues for non-profit organisations in domestic private equity funds is a great step forward.”

Private equity investors are showing optimism regarding market recovery. A survey conducted by the FVCA monitoring market sentiments indicates that while the current market situation is still viewed as challenging, there’s a notable shift towards positivity in future expectations. Over the next six months, an improvement in the availability of quality investment opportunities and the ease of exiting portfolio companies is anticipated.

Following a decline in market assessments during spring 2022, sentiments have remained largely negative for the past two years. However, there’s now a discernible turnaround in assessments, with future expectations leaning towards optimism.

” The growing optimism is supported by various indicators, such as economic growth forecasts and expected interest rate changes. We anticipate buyer and seller views on company valuations to align more closely, driving increased activity. While the M&A market may be slow to pivot, the wheels of change are already in motion”, Juhana Kallio concludes.

Read more about the 2023 private equity statistics here.

Read more about the private equity sentiment barometer here.

Jonne Kuittinen

FVCA, Deputy Chief Executive

jonne.kuittinen@fvca.fi

+358 44 333 3267

Juhana Kallio

FVCA, Chair of Board

juhana.kallio@interapartners.fi

+358 40 526 6629

Subscribe to our press releases

*Bain & Company: Global Private Equity Report 2024

**PwC Finland: Finnish M&A market update 2023