Categories

All

Quantum leap towards growth – IQM Quantum Computers is developing technology that can change the world

In just a few years, IQM Quantum Computers has solidified its position as the leading quantum technology company in Europe. In the future, the quantum computers developed by IQM...

Private equity and venture capital investors name 54 potential listing candidates – Is the IPO window about to open soon?

The IPO market has experienced an unusually prolonged period of quiet, but beneath the surface, preparations are underway in many companies. Private equity and venture capital investors play a...

Cooling excellence with a warm approach – MV-Jäähdytys is a Finnish cold maintenance pioneer, where employee well-being takes top priority

MV-Jäähdytys is a leading maintenance company in its field, serving all of Finland with its staff of 300 people. The company, which has practised responsible business for over half...

Riding on soundwaves: two entrepreneurs turned their passion into business and now Neural DSP is democratising access to world-class sound

Chile-born Douglas Castro and Francisco Cresp both came to Finland because of their love for Finnish heavy metal music and ended up founding a company together. Neural DSP designs...

Charged up and ready to go – Virta accelerates the global transition to cleaner mobility while achieving impressive growth

Entering the 2010s, electric vehicle development as we know it was starting to take shape, but there were only few who held the belief that the future of transportation...

Measurlabs raises €2.5M to help sustainability companies bring their products to market faster

Finnish Measurlabs, offering laboratory analysis and testing services that help researchers, quality assurance, and R&D professionals get the tests they need, has raised 2.5 million euros in a new...

Jonne Kuittinen Appointed Deputy Chief Executive of the Finnish Venture Capital Association

Jonne Kuittinen has been appointed Deputy Chief Executive of the Finnish Venture Capital Association (FVCA). With this appointment, Kuittinen will focus even more on highlighting the significance of private...

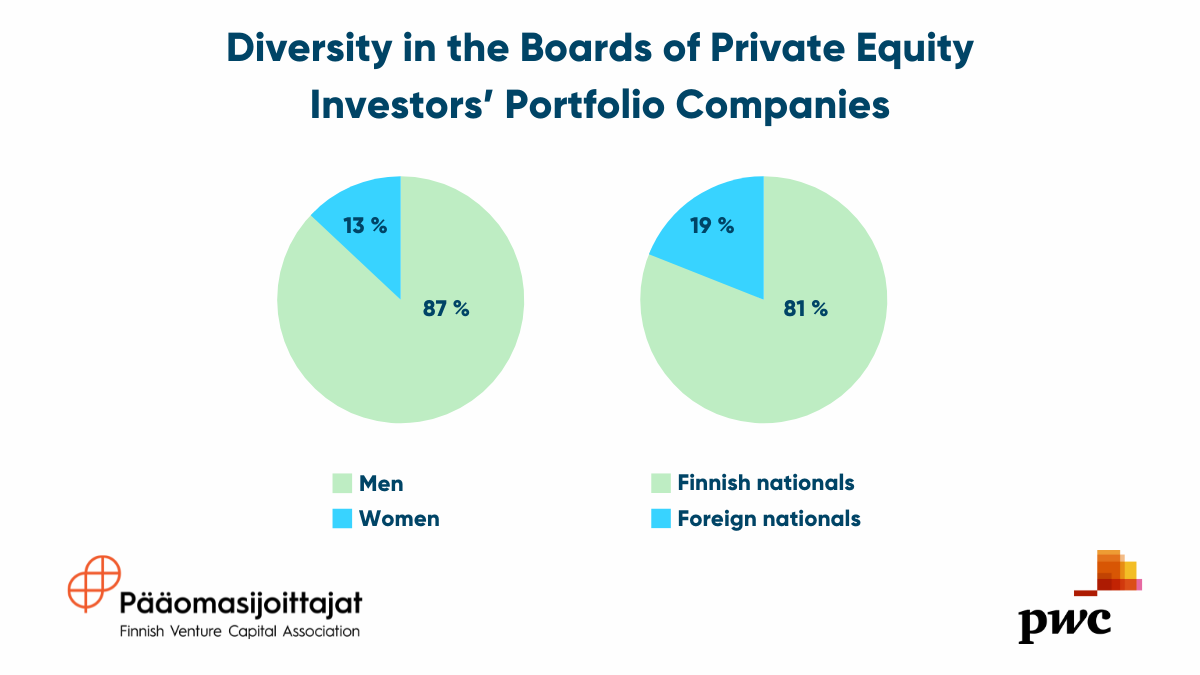

The boards of private equity-backed companies more international than peers – share of female board members remains at a low level

According to a recent diversity study, the share of women on the boards of companies owned by private equity investors remained low in 2022. However, the share of women...

Greencode Ventures supercharges the Green Transition with a successful first close

Greencode Ventures, a venture capital firm focused on accelerating the green transition through investing in digital-first startups, is thrilled to announce the successful first close of the new fund...

A strong and committed Finland needs immigration

The provisions related to immigration policy in the new government programme and the recent negative discourse surrounding immigration raise concerns in the venture capital and private equity industry. It...

Quantum computers, cooling equipment, amplifiers, and electric car charging solutions – The Building Growth 2023 finalists showcase groundbreaking technological expertise

The finalists for this year’s Building Growth Competition organized by the Finnish Venture Capital Association and PwC have been selected! The Building Growth competition seeks the most interesting and...

FVCA’s Master’s Thesis Competition is on again!

For the fifth year in a row, The Finnish Venture Capital Association is looking for the best Master’s thesis, which examines the private equity and venture capital industry from...