Read next

In the first half of 2023, Finnish buyout and growth investors (PE investors) have continued to actively invest in domestic growth-oriented SMEs. According to a recent barometer, investors find the current market situation challenging, but an improvement is on the horizon.

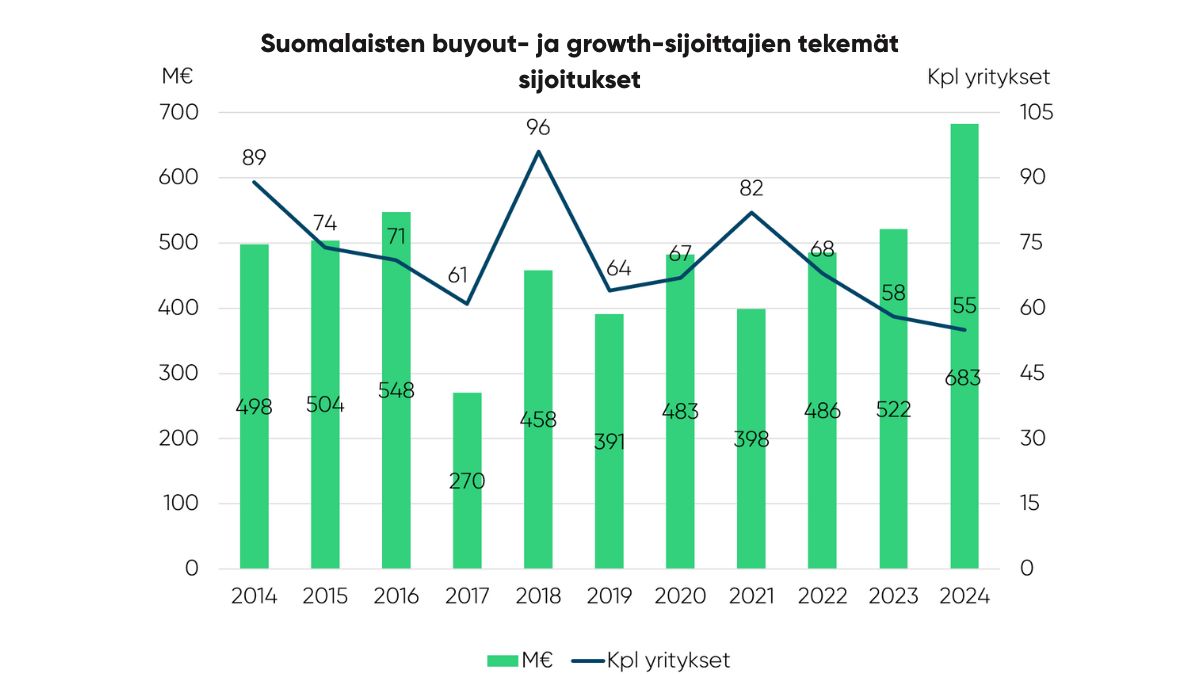

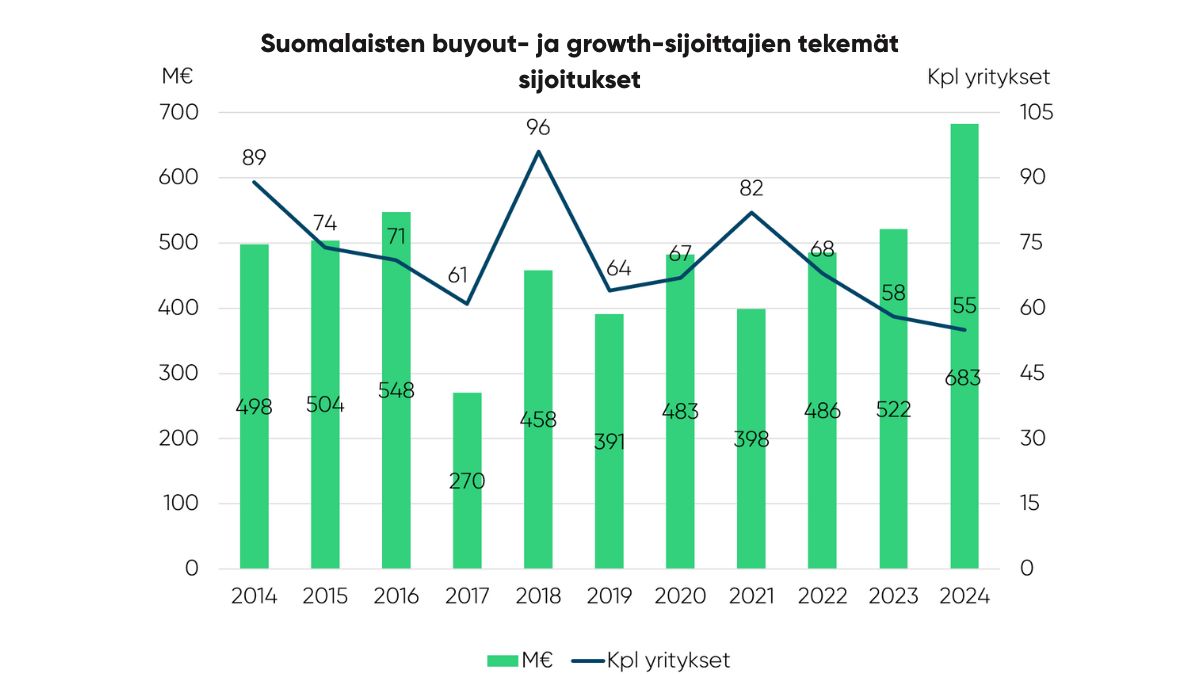

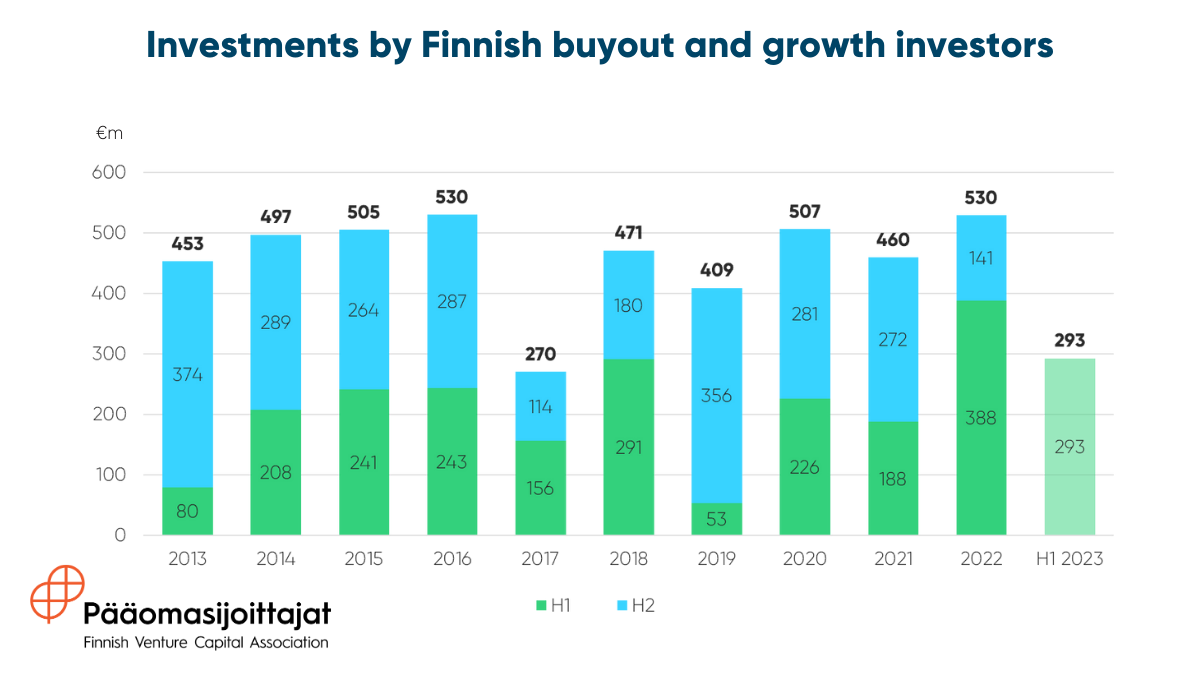

According to recent statistics from the Finnish Venture Capital Association (FVCA), buyout and growth investors have invested a total of €452 million in established Finnish growth companies during the first half of 2023. Of this sum, Finnish PE investors contributed €293 million, while foreign investors contributed €159 million.

Investments were made in a total of 40 Finnish companies during this period. Some of the companies that received investments include Finland’s leading online auction platform Huutokaupat.com, industrial maintenance and service specialist Elcoline, and the market leader in infrastructure construction, Welado.

While foreign buyout and growth investments in Finnish growth companies have been limited in the first part of the year, domestic PE investors have continued to make investments even more actively than average.

“The statistics highlight that Finnish PE investors are committed to investing in companies with growth potential irrespective of economic conditions,” comments Anne Horttanainen, Managing Director of FVCA.

The first half of the year has been quieter in terms of fundraising and exits from portfolio companies. Only €7 million were raised for Finnish buyout and growth funds, a notable decline from the average of half a billion euros annually over the last decade. Exits were also less frequent compared to the historical average.

“PE investors still have a significant amount of capital to invest, as many Finnish investors raised new funds in 2021 and 2022 before the changes in the macroeconomy. However, the fundraising environment has been extremely challenging since then,” comments Jonne Kuittinen, Deputy Chief Executive of FVCA.

The market situation is expected to remain challenging, but previous uncertainty is starting to fade

According to a recent barometer tracking the market sentiment of Finnish buyout and growth investors, fundraising, finding high-quality investment targets, and exiting from portfolio companies are perceived as more challenging compared to the situation six months ago.

Fundraising and exiting from portfolio companies are considered particularly challenging in the current market situation.

“As PE investors exit their portfolio companies, investment returns circulate back to the fund investors, such as pension funds. If exits do not occur, fundraising becomes more difficult. This situation is mirrored elsewhere in Europe,“ explains Kuittinen.

“Now it is especially important to take care of our domestic operating environment and remove obstacles to fundraising”, adds Horttanainen.

Based on the barometer results, a somewhat positive turnaround is expected in the next six months, suggesting that while the market situation will remain challenging, the worst may already be behind us.

“The results of the barometer reflect that the market situation is expected to remain challenging, but the outlook is clearer, which can positively impact activity. For instance, as the expectations for valuations begin to level over time, the views of buyers and sellers will meet again”, comments Juhana Kallio, Chair of the Board of FVCA and Managing Partner of Intera Partners.

Read more about the H1/2023 statistics here.

Additional information:

Anne Horttanainen

FVCA, Managing Director

anne.horttanainen@fvca.fi

+358 40 510 4907

Jonne Kuittinen

FVCA, Deputy Chief Executive

jonne.kuittinen@fvca.fi

+358 44 333 3267

Juhana Kallio

FVCA, Chair of Board

juhana.kallio@interapartners.fi

+358 40 526 6629