Categories

All

Member Blog: Balancing between Articles 8, 8+ and 9 of the SFDR regulation

Fund managers and financial advisors struggle with the SFDR regulation (the EU’s Sustainable Finance Disclosure Regulation, 2019/2088) when trying to interpret the rules and finding concrete procedures to tackle...

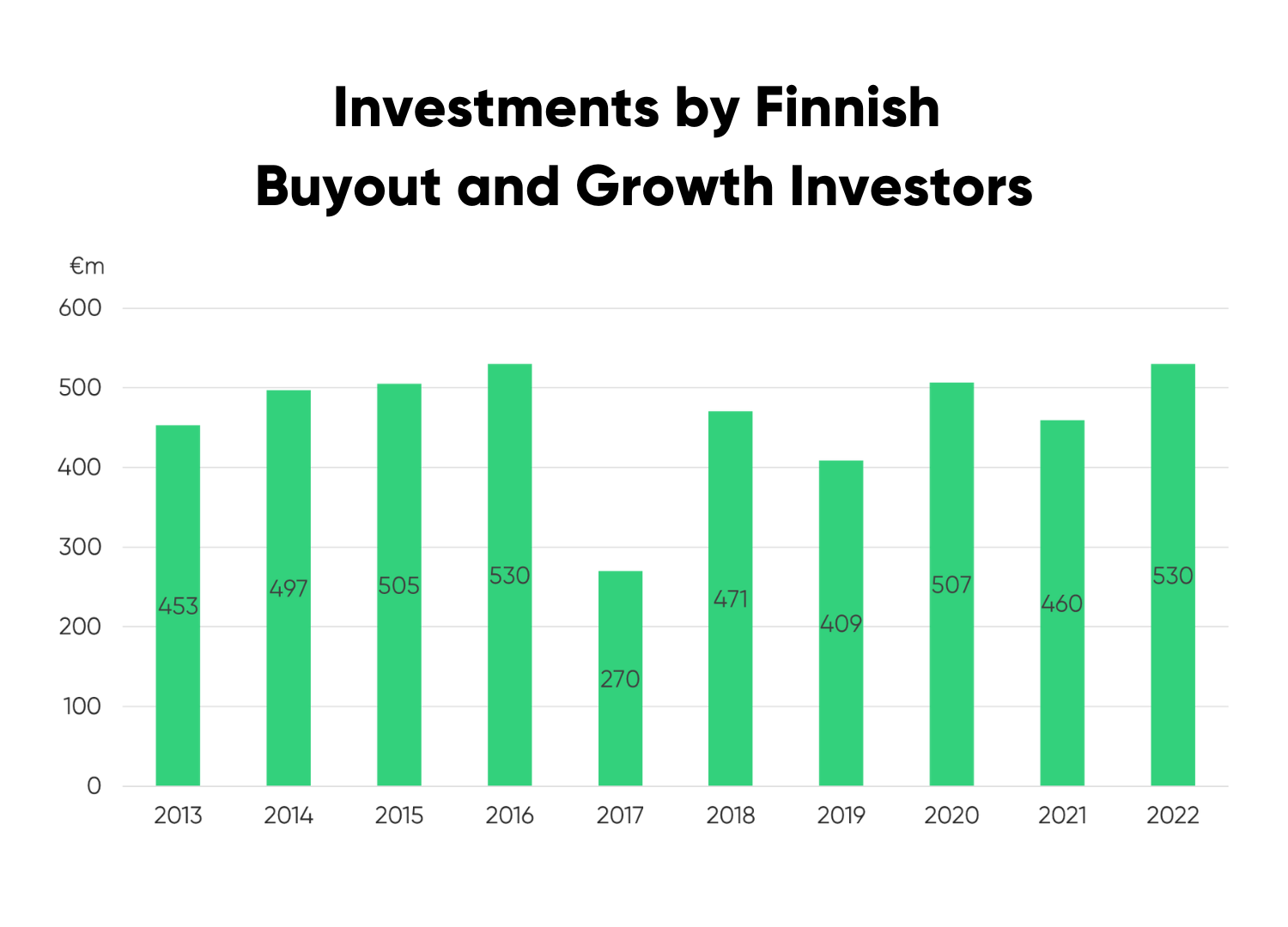

Boosting the growth of Finnish SMEs – Finnish buyout and growth investors invested half a billion in growth-oriented companies once again

Despite the general economic uncertainty, Finnish buyout and growth investors have continued to invest in growing SMEs at the same pace as in previous years – in 2022, the...

Meet the Finnish Venture Capital Association’s new members of the board

At the annual meeting of the Finnish Venture Capital Association, one new member and two new deputy members were appointed to the Board. They are Juho Frilander, Juhani Kalliovaara,...

IoT company Haltian raises 22M€ to help building owners hit their ESG goals

Finnish Internet of Things (IoT) company Haltian announced today their new growth funding of 22 million euros. The round was led by Mandatum Asset Management Growth Equity II fund ...

Introducing Juhana Kallio, Finnish Venture Capital Association’s New Chairperson of the Board

Juhana Kallio, who was appointed as the new Chairperson of the Board at the association's annual meeting, has worked in the finance industry for over 20 years. Working with...

Quanscient raises 3.9 million euros to accelerate hardware innovation with fast simulations

Quanscient, founded in 2021, is the first provider of cloud and quantum computing-powered multiphysics simulation technology. Quanscient offers fully digital R&D processes with its unique combination of native multiphysics...

eniferBio raises €11M to make planet-friendly fungal protein from the by-products of food and agricultural processes

The successful A-round was led by Aqua-Spark and joined by Tesi, Valio, Voima Ventures, and Nordic Foodtech VC. With the investment, eniferBio will begin to scale the production of...

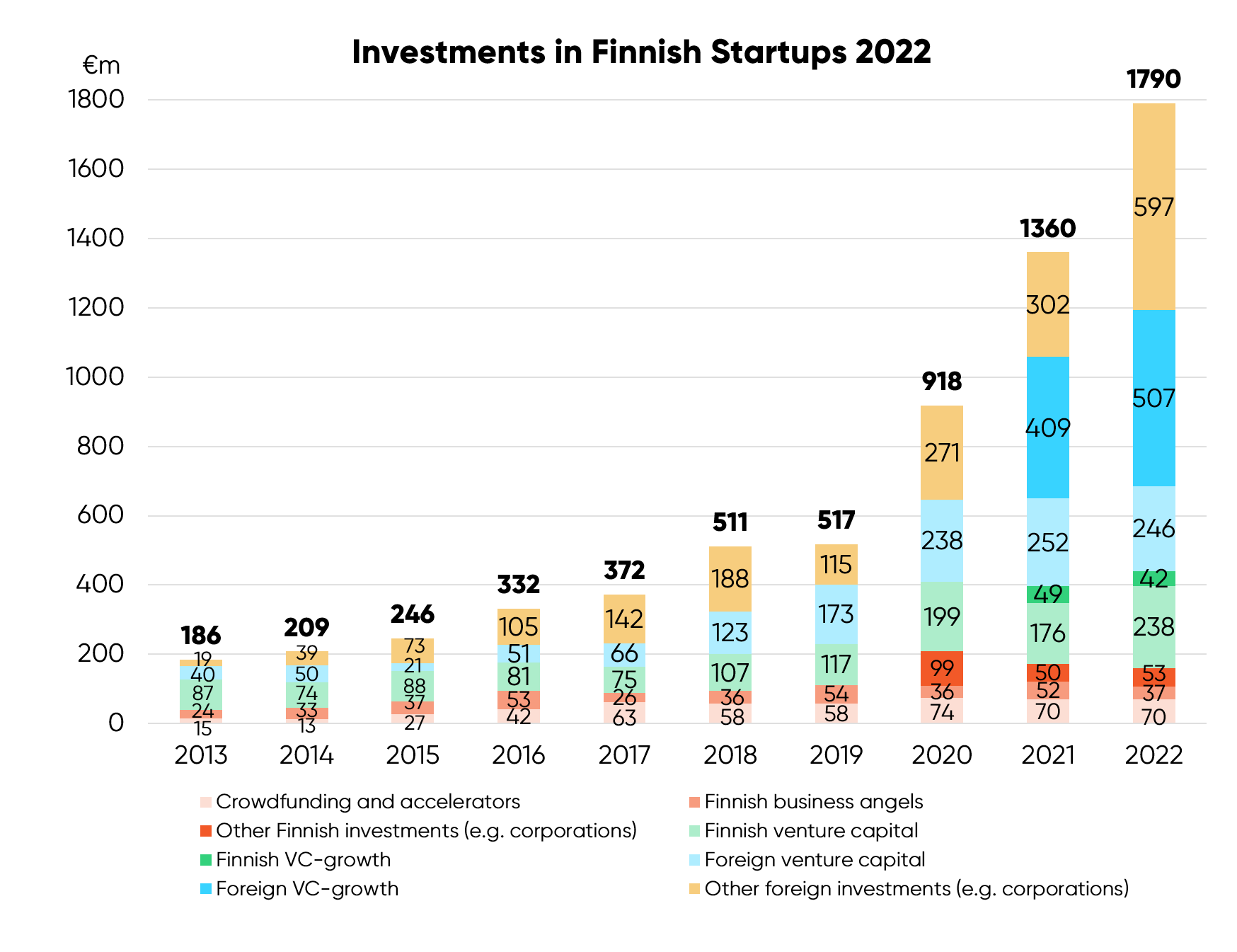

Finnish startups raised a record amount of funding once again – Total amount reached € 1.8 billion in 2022

The amount of capital raised by Finnish startups reached a new record last year. Of the total amount invested in Finnish startups, almost 60 per cent came from venture...

MB Funds and Welado have found a match

Finnish infrastructure consultant Welado gets MB Funds, a private equity company with over 30 years of experience, as its main owner. The founding entrepreneurs and the management of Welado...

Meet our member Almaral: “We are active and hands-on mentors to our portfolio companies”

Almaral is a family-owned venture capital firm investing in early-stage biotechnology and life sciences startups. The firm was founded in 2022 after CEO Maria Severina had sold her biotechnology...

MVision AI raises 5.4M€ to supercharge cancer treatment with AI

MVision AI is the first cloud-based AI-powered radiotherapy planning solution for treating cancer. MVision uses artificial intelligence to automate cancer treatment planning with its unique automatic segmentation tool. The...

Tesi’s Diversity Review: Number of women doubled in VC & PE investment teams, yet progress remains to be made

Tesi’s Diversity Review of venture capital & private equity investment teams shows progress has been made over the years, but still much needs to be done to improve diversity....