Read next

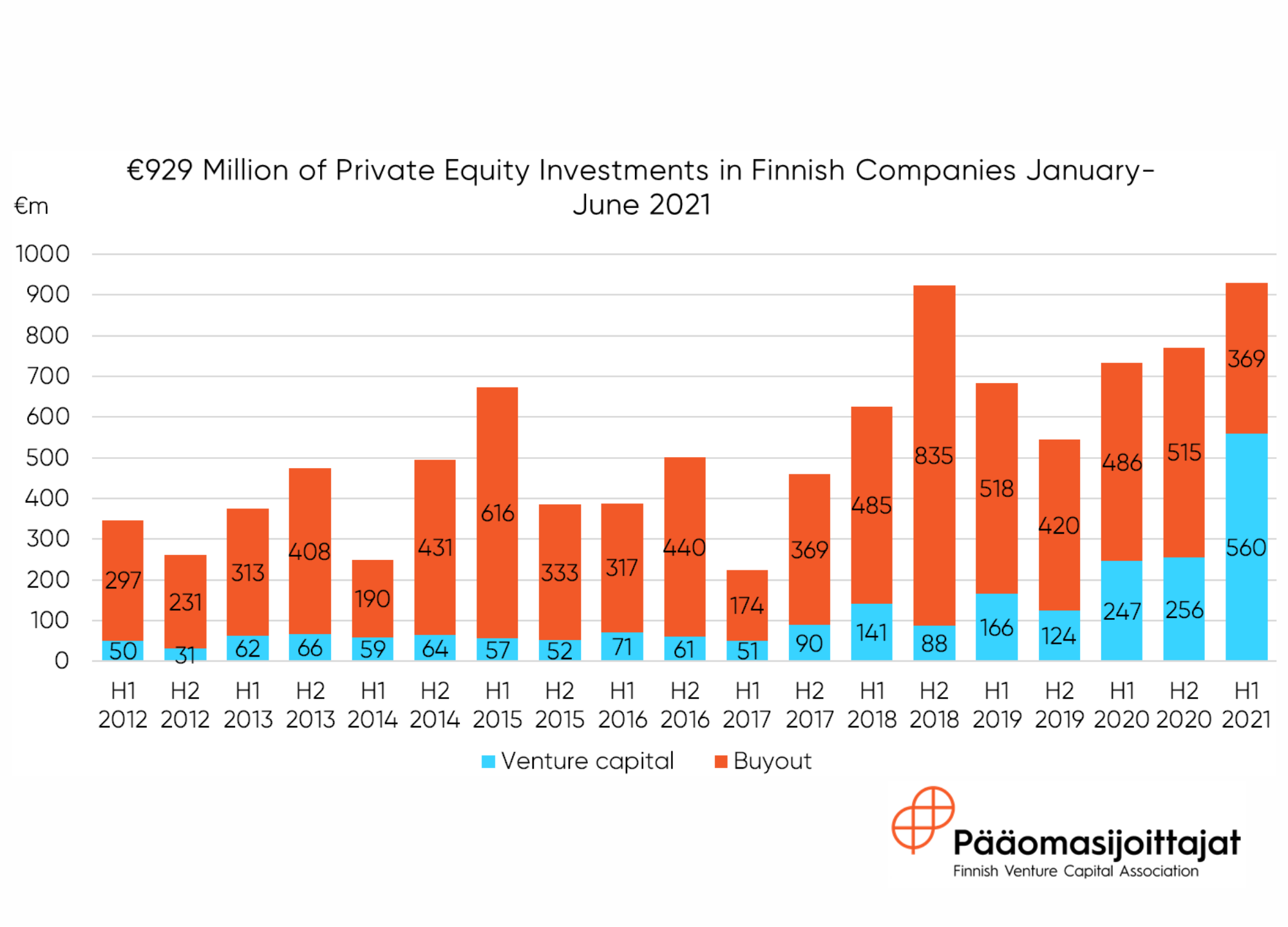

Finnish companies received €929 million in private equity investments in the first half of the year, an all-time high in a six-month period. The record €1.5 billion that was invested in Finnish companies in 2020 is expected to be exceeded in 2021.

Both established growth companies, which often operate in traditional industries and startups raised a significant amount of funding – a total of €929 million – in the first half of 2021. Of the total amount, €653 million was invested by foreign investors and €276 million by Finnish investors.

Private equity investors invest in both startups and larger, more established companies. Investors are often specialised in companies at a certain stage of growth.

“The term active ownership is a good word to describe private equity investing. Whether an idea-level startup or an industrial company with a hundred-million turnover, private equity investors help accelerate the growth of their portfolio companies not only with financing but also with their expertise. This means, for example, helping develop the company through board work,” says Pia Santavirta, the Managing Director of the Finnish Venture Capital Association (FVCA).

Finnish private equity funds have also raised a good amount of new capital from domestic and foreign fund investors. During the first six months of this year, a total of €640 million has been raised in private equity funds. Throughout last year, private equity funds raised a total of €879 million to be invested in growth-oriented companies in Finland and abroad.

“There are a lot of companies in Finland with the potential to grow into Finnish market leaders, for example, as long as their growth plans are clear and there is funding available for them. Hopefully, recent news, such as the acquisition of Wolt and the busy year in the IPO market, will encourage companies of all sizes to pursue rapid growth,” Santavirta continues.

FVCA’s Managing Director Pia Santavirta and the association’s Chairperson Janne Holmia, partner at the international private equity firm Verdane, list five directions in which they believe the Finnish private equity industry is heading:

Impact and Responsibility

According to Santavirta and Holmia, private equity investors are increasingly investing in companies that not only have growth potential, but also a positive impact on the environment and society. Investing in sustainable development offers interesting business opportunities. “I believe that both startups innovating in sectors like energy and material technology, as well as more traditional companies willing to change old ways of working, are at the forefront of solving our time’s major issues, like climate change,” Santavirta comments.

More Mega Rounds Raised by Startups

Of the fifteen largest funding rounds raised by Finnish startups, ten have been raised in the last two years. The €440 million round raised by Wolt broke all records in the Finnish startup scene, but there are many other success stories brewing right behind. This year, large rounds have been raised, for example, by Iceye (€74 million) and Aiven (€84 million).

Tech Companies and Digitalisation Attracting Investments

There has been a shift towards more and more investments being made in both technology companies, as well as companies in other industries, which are utilising digitalisation to achieve growth. ”The pandemic, if nothing else, has pushed companies to digitise their operations. Investments by private equity investors, where digitalisation is not a part of the company’s value creation plan, are few and far between, ” comments Santavirta. “Finnish tech companies are also of interest to international investors, and there is a lot of know-how and innovation in Finland in the field of health technology, for example,” Holmia continues.

Investments in Venture Capital Funds

For more than a decade, private equity funds have been one of the most lucrative asset classes for fund investors. Historically, the majority of institutional investors’ investments in Finland have been made in buyout funds, which invest in established growth companies, and the fundraising activity of buyout funds has remained at a steady level. The startup investment side has seen strong growth in recent years. The returns of venture capital funds have risen, which in turn has made them attractive investment opportunities for institutional investors.

More Growth Funds and Investments

Growth investors look for potential portfolio companies between early-stage startups and larger companies targeted by buyout investors. The strategy may be, for example, to invest in technology companies after they have passed the startup phase, or to invest in smaller companies in more traditional industries. Investments from growth investors may also be sought after in situations where a family business is going through generational change. “The diversifying group of private equity investors and their expertise of different growth stages offer more and more Finnish companies support on their growth path,” Holmia concludes.

Additional information:

Finnish Venture Capital Association

Pia Santavirta, Managing Director

pia.santavirta@fvca.fi

+358 40 546 7749

Janne Holmia, Chair of the Board

janne.holmia@verdane.com

+358 40 084 3333