Read next

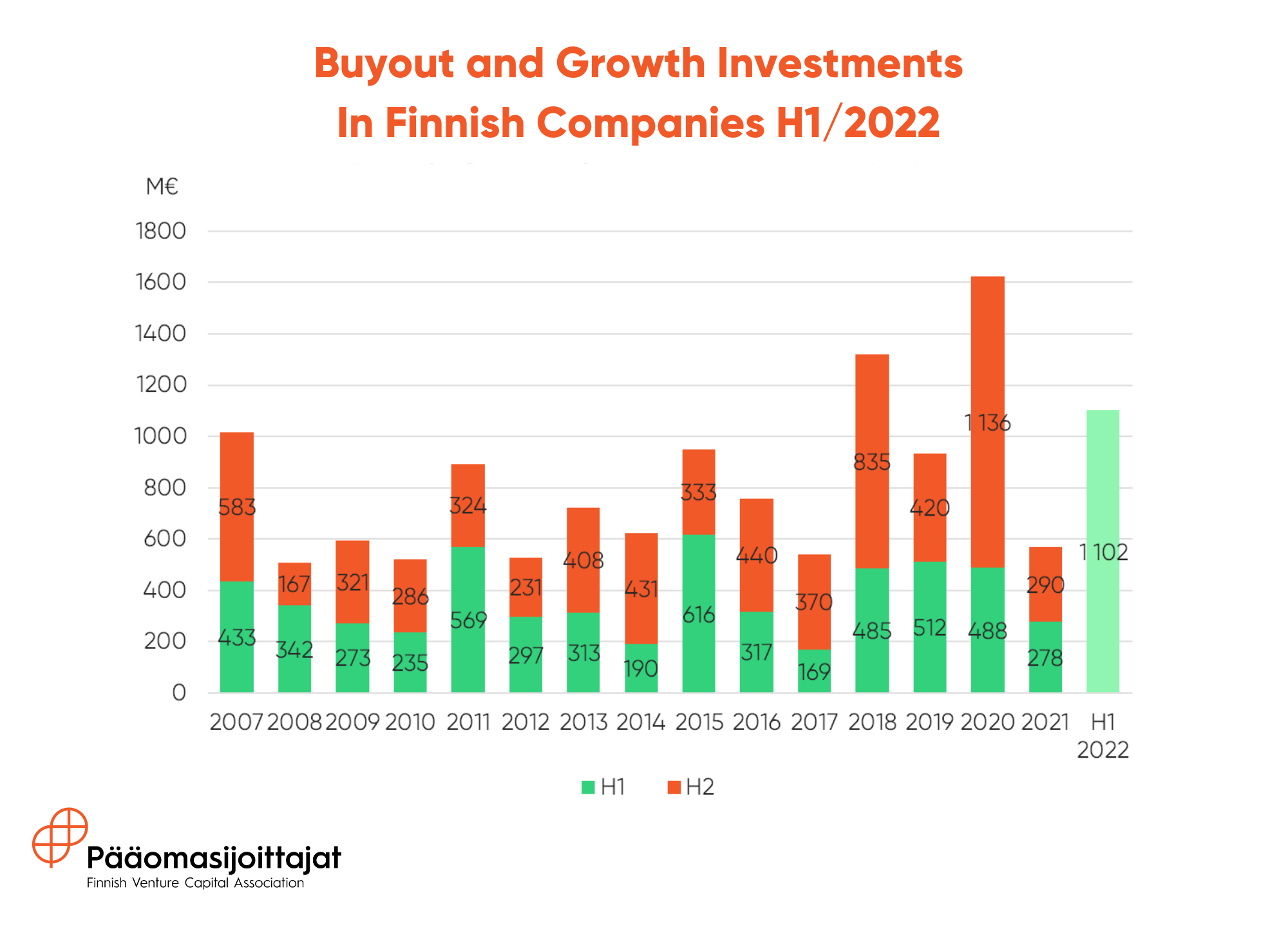

According to recent investment statistics, established Finnish growth companies have received a large amount of growth financing from private equity investors (PE investors) during the first half of 2022. The €1.1 billion jackpot is the second-best half-year in history.

The investments made by private equity investors making buyout and growth investments were divided among 44 domestic growth companies. €332 million of the financing came from Finnish PE investors and €771 million from foreign investors. International PE investors are often involved in the largest acquisitions.

Both domestic and foreign investments were distributed to growth companies all over Finland. Companies from 11 different regions received investments during the six-month period. After Uusimaa, the largest investment amounts went to Central Finland, Southwest Finland, Lapland, Kainuu and Pirkanmaa.

“Domestic PE investors are determinedly growing the new rising group of medium-sized companies throughout Finland. 95 percent of the investments made by buyout and growth investors are aimed at the growth and internationalisation of Finnish companies“, says Juhana Kallio, Managing Partner of Intera Partners and Vice Chair of the Board of the Finnish Venture Capital Association.

According to a recent barometer that follows the market sentiment of Finnish PE investors, good investment opportunities are available and investments in growth-oriented companies are being made as usual. The barometer examined the current market situation and compared it with the situation six months ago.

”PE investors make investments in companies capable of growth in all market situations. Private equity investments create stability – funding and know-how and through that, for example, jobs – even in unstable times”, comments Pia Santavirta, Managing Director of the Finnish Venture Capital Association.

Fundraising Environment Is Becoming More Challenging

Last year, records were broken in fundraising of private equity funds, as Finnish investors raised almost €1.5 billion to be invested in promising companies. Large institutional investors, for instance, invest in PE funds, with the most significant investor group being domestic pension insurance companies.

However, during the first half of this year fundraising has been significantly slower: only €45 million has been raised. No new funds were published during the beginning of the year.

Last year’s peak in fundraising partially explains the quieter phase of the beginning of this year. In addition, according to the private equity barometer, the fundraising environment seems more challenging than six months ago.

“Instability in Europe and globally has brought additional challenges to fundraising for Finnish private equity funds. In general, LPs seem to be slightly more cautious. Therefore, it is particularly important to take good care of the domestic operating environment and ensure that Finland continues to be an internationally attractive investment destination. The domestic LP field needs to be diversified so that there is enough growth capital for companies that want to grow in the years to come”, Santavirta concludes.

Read more here

Pictures and logos for media

More information:

Pia Santavirta

FVCA, Managing Director

pia.santavirta@fvca.fi

+358 40 546 7749

The answers for the FVCA’s private equity and venture capital barometer were collected between October 19-24, 2022. The purpose of the survey is to map the situation of PE investment and financing of startups and growth companies. The survey was sent to 483 employees of Finnish PE companies, and answers were received from a total of 103 people. It was possible to answer the survey anonymously, but based on the filled-in personal information, at least 37 different private equity funds participated in the survey.

PRIVATE EQUITY INVESTORS

Private equity investors are active owners. They invest in non-listed startups and growth companies aiming at strong growth, innovation, and internationalisation. Private equity investors bring their portfolio companies not only capital but also risk appetite, expertise, and extensive contact networks. Private equity investors typically exit the portfolio company after 3 to 7 years, after which the company moves on to its next strategic growth phase. Potential exit methods include, for example, an IPO, selling the company to another private equity investor or a trade sale.

Private equity investors can be divided into two separate groups.

1) Venture capital investors make investments from venture capital funds into startups, becoming minority owners in their portfolio companies.

2) Buyout investors target more established growth companies. The investments can be majority or minority investments. The minority investments are often called growth investments.

This release covers buyout and growth funds and established growth companies.

Finnish Venture Capital Association (FVCA) is the industry body and public policy advocate for the venture capital and private equity investors in Finland. We represent a diverse group of investors, that build sustainable growth and whose target companies employ more than 70 000 employees. Twitter | LinkedIn | Instagram | Subscribe to our newsletter