Read next

The ongoing economic uncertainty has taken its toll on startup investments, with Finnish startups witnessing a significant decrease in funding raised in 2023 compared to previous record-breaking years. However, despite the challenging market conditions, Finnish venture capital funds managed to secure nearly record-breaking amounts of new capital for future investments.

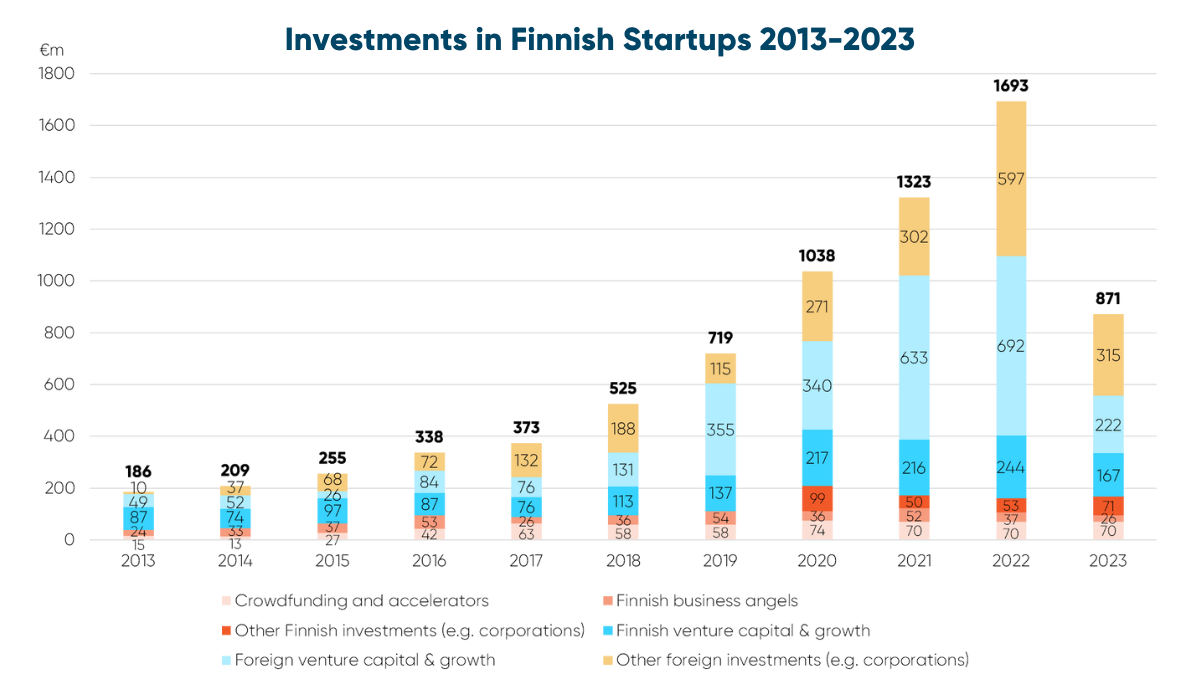

According to the latest statistics from the Finnish Venture Capital Association (FVCA), Finnish startups raised a total of €871 million in growth funding in 2023. This marked a decrease of about half compared to the preceding year’s record-breaking €1.7 billion. This decline mirrors the trend of financing slowdown observed both in Europe and the United States.

The decrease in investment amounts can be attributed primarily to a notable reduction in large investment rounds and an overall decrease in the sizes of financing rounds. Last year’s largest startup investment round, totalling €162 million, was raised by Hostaway, the world’s leading vacation rental customer relationship management software. For comparison, in 2021, Wolt raised €440 million, and in 2022, Relex secured a €500 million investment round.

The majority of the funds from large financing rounds are sourced from foreign investors, whose investments experienced a significant decline, dropping by 58% from the previous year. Conversely, the amount invested by domestic investors in startups saw a relatively smaller decline of 17%.

Startup funding is typically sourced from venture capital investors, angel investors, and other investment entities such as corporations. In 2023, venture capital investments accounted for €389 million of the total funding raised, with €167 million contributed by domestic investors and €222 million by foreign investors.

“Finland has laid a solid foundation for financing domestic startups through years of concerted effort, which has been crucial in light of the significant decrease in foreign capital. In response to the tightening market, startups have also taken proactive measures to enhance capital efficiency”, comments Jussi Sainiemi, Deputy Managing Partner of the venture capital firm Voima Ventures and Chair of FVCA’s Venture Capital Committee.

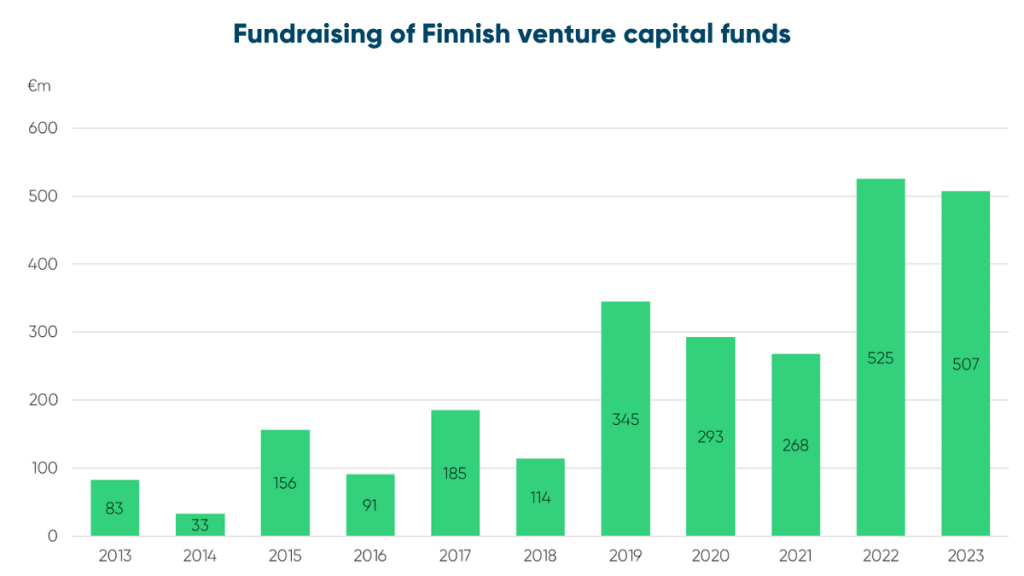

Despite the prevailing market challenges, Finnish venture capital funds managed to maintain fundraising levels close to records in 2023, raising a total of €507 million of new capital.

Lifeline Ventures announced Finland’s largest venture capital fund last year, totalling €150 million. In addition, Voima Ventures, IPR.VC, Gorilla Capital, and 3TS announced their new funds in 2023.

Several new players also entered the market as Greencode Ventures, Kvanted, and Failup Ventures published their first funds.

“The successful fundraising efforts of Finnish venture capital funds enable Finnish startups to be financed further with domestic resources. However, until the scale of domestic funds matches that of international standards, we remain reliant on foreign investors for large later-stage financing rounds”, comments Jonne Kuittinen, Deputy Chief Executive of FVCA.

The investment companies of wealthy Finnish families, e.g. family offices, have become increasingly active as fund investors. In 2023, family offices contributed €167 million to the funds raised, marking a significant increase compared to previous years.

”The returns generated by venture capital funds and the success stories of startups have attracted new family office investors. To increase the size of domestic funds, we must also focus on attracting more foreign fund investors and eliminating unnecessary domestic regulatory barriers, such as restrictions on investments from foundations into venture capital funds,” Kuittinen concludes.

Read more about the 2023 statistics here.

Additional information:

Jonne Kuittinen

FVCA, Deputy Chief Executive

jonne.kuittinen@fvca.fi

+358 44 333 3267

Jussi Sainiemi

Voima Ventures, Deputy Managing Partner

jussi.sainiemi@voimaventures.com

+358 40 564 4660

Juulia Korkiavaara

FVCA, Head of Communications

juulia.korkiavaara@fvca.fi

+358 40 673 8376