Read next

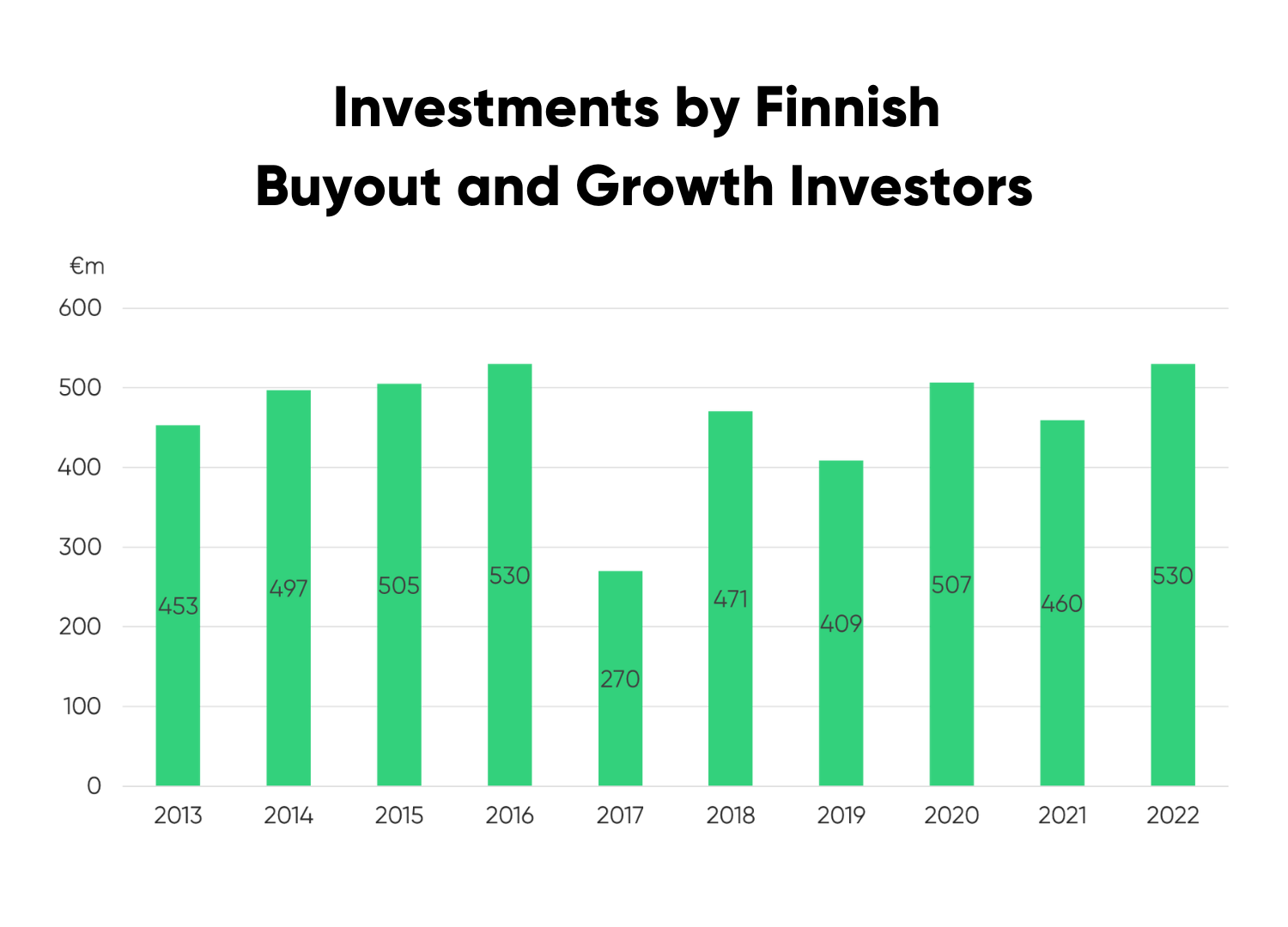

Despite the general economic uncertainty, Finnish buyout and growth investors have continued to invest in growing SMEs at the same pace as in previous years – in 2022, the amount invested again reached over half a billion euros. Record amounts of capital have been raised to private equity funds in recent years, indicating that investments in companies seeking growth partners can be expected in the future as well.

In 2022, Finnish buyout and growth investors invested a total of €530 million into 75 unlisted small and medium-sized enterprises (SMEs).

While the early 2020s have been marked by various crises, Finnish private equity investors have maintained a remarkably stable level of investment activity. Over the past five years, Finnish buyout and growth investors have annually invested an average of half a billion euros in around 80 SMEs to accelerate their growth.

“Private equity investors form a stable and reliable engine that drives Finnish companies forward, regardless of market conditions. As statistics show, we have a functioning financing ecosystem for unlisted companies in Finland, which operates steadily despite the turmoil in the world”, comments Anne Horttanainen, Managing Director of the Finnish Venture Capital Association.

The growth expertise of Finnish buyout and growth investors has primarily been harnessed to accelerate the growth of domestic SMEs. Continuing the trend from previous years, over 90% of the investments made in 2022 were directed towards domestic companies. The investments were dispersed throughout the country, with Central Finland and Pirkanmaa receiving the highest investment volumes after Uusimaa.

Some of the companies that received investments in 2022 include digital job search and recruitment services provider Duunitori, staffing services company Bolt.Works, cybersecurity and IT services provider Netox, and electric vehicle managed service provider Eva Global.

“Private equity investors are active owners who invest in companies with growth potential. We offer concrete support to achieve this goal and help companies throughout Finland to grow and internationalise,” says Juhana Kallio, FVCA’s Chairperson of the Board and Managing Director of Intera Partners.

According to a study conducted by the Finnish Venture Capital Association and PwC in 2022, the growth of private-equity-backed companies is eight times faster in terms of turnover and twenty times faster in terms of number of employees than that of peer companies.

Record Capital Raised in Recent Years – Focus Should Also Be on Future Development

Between 2018 and 2022, Finnish buyout and growth funds have raised a record-breaking €3 billion in new funds. There is a significant amount of dry powder, or unallocated capital, in the funds presently.

In 2022, several growth funds that make minority investments were published, as Mandatum Asset Management and Nordia Management launched their second funds, and Voland Partners began its operations as a new player in the growth fund field. Additionally, Taaleri launched a new biotechnology fund and Saari Partners launched its second buyout fund in 2022.

“Currently, there is plenty of funding available for growing companies. Private equity investors, as long-term-focused investors, continue their operations as usual through different economic cycles. New investment opportunities are actively being sought now“, says Kallio.

According to a recent barometer tracking market sentiments among Finnish private equity investors, buyout and growth investors perceive that there are as many high-quality investment opportunities available as before. The barometer examined the current market situation and compared it to the situation six months ago.

On the other hand, fundraising is perceived to have become more difficult, and there is an increased general caution among fund investors.

“To strengthen domestic ownership, our financing ecosystem must grow and become more international. The obstacles to domestic and foreign fundraising for private equity funds must be removed, and funds must have competitive opportunities to attract growth capital to Finland,” Horttanainen comments.

Exits Remained Steady Despite a Decline in IPOs

Private equity investors own a portfolio company for a certain growth phase, after which investors exit, i.e., sell their stake in the company. 2022 saw a sharp decline in initial public offerings both in Finland and globally and exits through IPOs were not made by private equity investors either. About half of the companies listed on the Helsinki Stock Exchange between 2015 and 2021 have been private-equity-backed.

However, last year there were 38 successful exits through other routes, which is in line with the average of the last five years. Most exits were trade sales or sales to another private equity investor.

“Companies’ IPO readiness is being developed as usual, and the stock exchange remains an interesting exit option for investors. It’s great that successful exits have been made at a steady pace despite the challenging market situation, and there have been no write-downs in 2022. The profits from the exits are distributed to fund investors, such as Finnish pension funds,” Horttanainen concludes.

Additional information:

Anne Horttanainen, Managing Director, FVCA

+358 40 510 4907, anne.horttanainen@fvca.fi

Juhana Kallio, Chairperson of the Board, FVCA

+358 40 526 6629, juhana.kallio@interapartners.fi

Juulia Korkiavaara, Head of Communications, FVCA

+358 40 673 8376, juulia.korkiavaara@fvca.fi

FVCA is the industry body and public policy advocate for the venture capital and private equity industry in Finland. As the voice of the Finnish VC and PE community and the entrepreneurs they fund, it is our role to demonstrate the positive impact of the industry on the Finnish economy. FVCA – Building growth.

Twitter | LinkedIn |Instagram | For Media | Subscribe to FVCA’s Newsletter