Read next

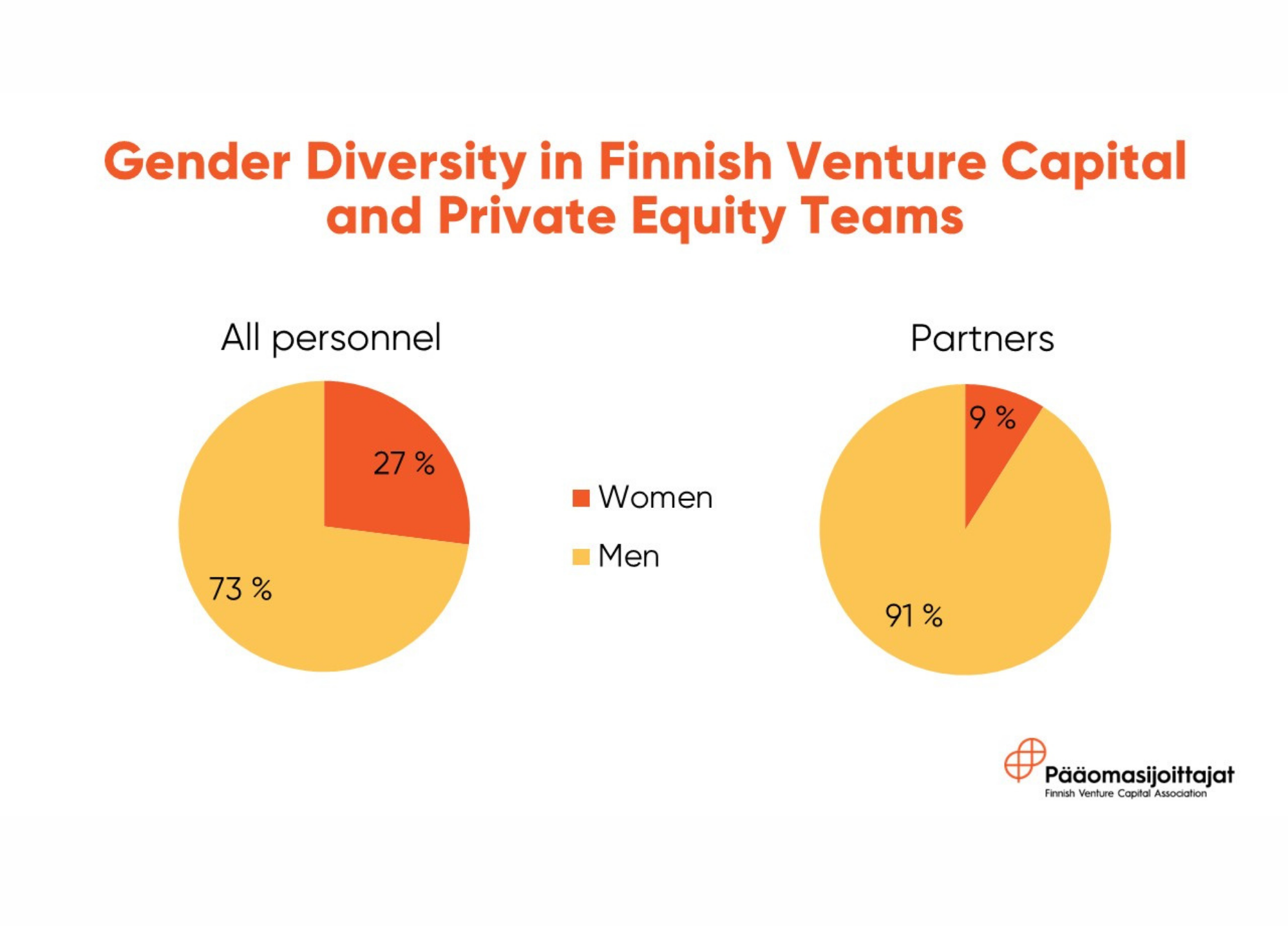

The private equity and venture capital industry in Finland has seen rapid growth in recent years. In the past two years, the number of employees in the industry has increased by almost a fifth. However, Finland lags behind the rest of Europe when it comes to the industry’s gender diversity. Around half of Finnish investors have no women in their investment teams, while only about a tenth of investment teams across Europe are all-male. 20% of investment team professionals in Europe are women, while in Finland, the share of women in investment teams is 15%. Although the industry has grown rapidly in Finland, the share of women is lagging behind.

According to the Finnish Venture Capital Association’s (FVCA) diversity review, in the autumn of 2021, there were over 450 people working in the private equity and venture capital (later private equity) industry in Finland. This is approximately 70 people more than in 2019 when the issue was last looked at. The number of employees in the private equity industry has increased by almost a fifth in two years. Although the industry has grown rapidly in Finland, the share of women is lagging behind.

According to a study by the British Private Equity and Venture Capital Association (BVCA) and Level 20, women make up 38% of the workforce in the private equity industry in Europe. However, investment decisions are made by the investment teams, where the proportion of women is only 20%. Women are even further underrepresented in Finnish teams: According to FVCA’s review, women make up 27% of the Finnish private equity industry, and the proportion of women in investment teams is only 15%,

Almost a half of Finnish private equity firms have no women in their investment teams. The European-wide situation is much better: According to the study by BVCA and Level 20, only 12% of investment teams are all male.

Women are in a clear minority also at the partner level in Finland. 61 private equity firms with a total of 212 partners were included in FVCA’s diversity review. 19 of these 212 partners – or 9% – are women. Of all 61 firms, a staggering 46 have no female partners. This means that three out of four private equity firms have only men at the partner level.

The BVCA and Level 20 study looked at diversity in mid-level and senior-level positions instead of partner-level. According to the study, 20% of mid-level and 10% of senior-level investment professionals are women.

The FVCA’s review shows that between 2019 and 2021, a total of 57 new male partners have been appointed to Finnish investment teams, which means an increase of 42%. The number of female partners has increased by 36%, but this still corresponds to only five new female partners. All of the new female partners appointed work in venture capital firms. In the last five years, 16 new venture capital firms have been established in Finland.

The share of women is much higher in the non-investment teams of private equity firms, which include, for instance, legal and HR roles, as well as administrative support roles. In Finland, nearly 60% of employees in non-investment teams are women.

“The fact is that only about 2% of all venture capital investments are channelled to female-founded companies globally. This has to change,” comments Pia Santavirta, Managing Director of the FVCA.

Increasing the diversity of investment teams impacts who gets funded. Studies have found that gender-diverse investment teams are twice as likely to invest in gender-diverse founding teams and three times as likely to back companies with female CEOs.

In addition, multiple studies have found that investing in companies founded or co-founded by women brings better outcomes: startups with at least one female founder generate more revenue and exit faster than their all-male-founded counterparts.

“Naturally, our goal is a level playing field for all promising companies looking for funding, and having more diverse investment teams is a step in that direction. After all, when investment decisions are being made by people with different backgrounds, skillsets, and networks, the best ideas are more likely to be found and supported,” Santavirta comments.

The challenges regarding diversity have been recognised in the private equity industry in Finland, and many initiatives to increase diversity in the industry are underway. FVCA aims to increase diversity through the following initiatives, for instance:

• We support the activities of Level 20, an organisation whose goal is for women to hold 20% of senior positions in the European private equity industry.

• At the beginning of 2021, we collaborated with Nasdaq Helsinki and Allbright to host unconscious bias training for investors and business leaders.

• We have taken part in organising a training program about venture capital and private equity in collaboration with Aalto ENT.

• In collaboration with Business Finland Venture Capital, we have organised a series of training sessions on founding a venture capital fund.

• Our mentor program has helped connect students and industry newcomers with private equity and venture capital professionals.

• We have promoted the private equity and venture capital industry as a career possibility at various events.

• We have encouraged students to explore the industry in their studies through our annual Master’s Thesis Competition.

• We support the activities of Aalto University’s and Hanken’s Women’s Career Society and the brand new Aalto Private Equity Club.

FVCA

Pia Santavirta, Managing Director

pia.santavirta@fvca.fi

+35840 546 7749

Methodology:

Finnish Venture Capital Association: 61 Finnish private equity and venture capital firms were included in the review. The review’s data was collected in August 2021. In the analysis, CEOs are considered as partners. Not all investment firms analysed had a partner structure.

British Venture Capital Association and Level 20: The BVCA/Level 20 Diversity and Inclusion Survey 2021 provides insight into gender representation based on data gathered on 186 private equity (81) and venture capital firms (61) comprising 8,746 employees in the UK and Europe. This study includes BVCA and Level 20 members, so does not represent the entire industry.