Read next

The slow merger and acquisition (M&A) market has been evident in the low volume of private equity investments in Finnish SMEs during the first half of 2024. However, private equity investors’ market sentiment has turned significantly more positive over the past six months, while portfolio companies have continued to show strong growth.

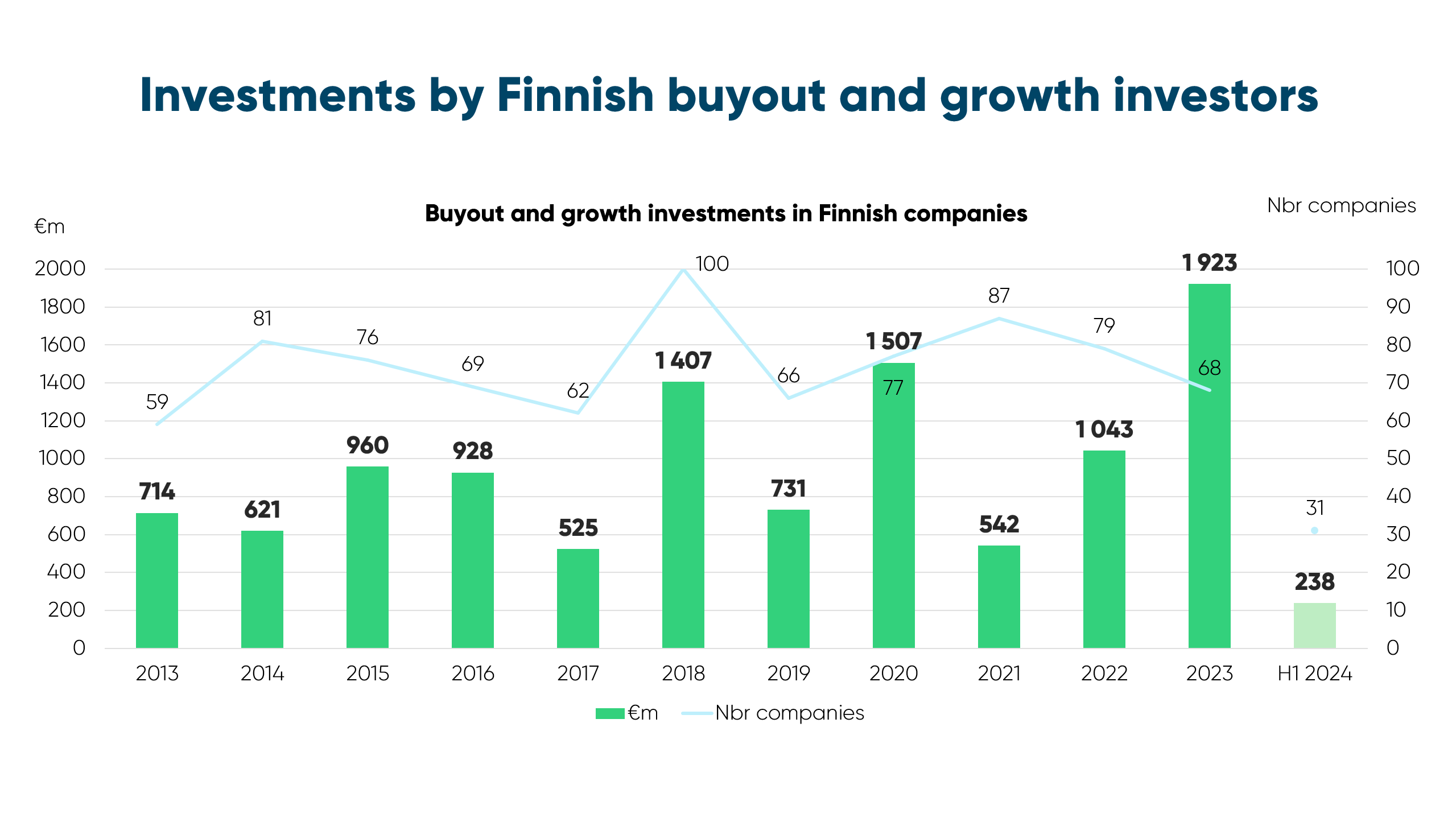

According to recent statistics from the Finnish Venture Capital Association (FVCA), Finnish buyout and growth investors invested €124 million in growth-oriented unlisted SMEs in the first half of 2024. The total amount was spread across 23 companies, all based in Finland.

This marked one of the quietest periods in years for both the value and volume of investments. Exits also remained scarce, with Finnish buyout and growth investors completing only six exits in the same period.

“M&A activity has hit its lowest point in years, both in Finland and globally, and this is reflected in the private equity statistics. However, during the turbulent 2020s, Finnish private equity investors have already invested over €2 billion in domestic SMEs,” says Jonne Kuittinen, Deputy Chief Executive of FVCA.

According to a recent barometer tracking the market sentiment of Finnish buyout and growth investors, there has been a clear positive shift in the operating environment over the past six months.

Investors report an increase in high-quality investment opportunities and improved conditions for portfolio company exits. This positive trend is expected to continue over the next six months.

However, fundraising for private equity funds remains challenging, though conditions are anticipated to improve slightly in the near future.

“Feedback from investors and advisors indicates that the market is clearly picking up, with many transactions currently in the pipeline. The fundraising environment is expected to improve once exits start to flow through and private equity firms can return profits to their investors”, comments Kuittinen.

While transaction activity was rather quiet in the first half of 2024, much of the work done by private equity investors is focused on value creation within portfolio companies.

Recent research shows that Finnish companies owned by private equity investors are growing significantly faster than their peers in terms of revenue, employment, and productivity.

“Even though Finland’s economic growth has been negative in recent years, private equity-backed companies have continued to grow. Last year alone, these companies created over 2,000 new jobs, while overall private sector employment in Finland declined by approximately 13,000 jobs,” notes Juhana Kallio, Chair of Board at FVCA and Managing Partner at Intera Partners.

Read more about the statistics here.

Read the investor sentiment survey results here.

Jonne Kuittinen

FVCA, Deputy Chief Executive

jonne.kuittinen@fvca.fi

+358 44 333 3267

Juhana Kallio

FVCA, Chair of Board

juhana.kallio@interapartners.fi

+358 40 526 6629